Santander

-

-

Challenger bank's senior notes land just 1bp outside Santander's recent trade

-

◆ First senior preferred trade in a month ◆ Santander extends its SP curve ◆ Slim premium on both tranches

-

◆ Santander and SEB print sterling seniors ◆ 'Opportunistic window' for issuers ◆ Possible sign of busy sterling market next week

-

UK bank trio stands out in heavy Yankee onslaught either side of Fed meeting

-

Tom Hall talks to George Smith about the lively and Santander-dominated European ABS primary market, before discussing the bankruptcy of US ABS issuer Tricolor with Chad Van Estrop

-

Bank recruits three for public sector debt capital markets, another to move out to Middle East

-

Financial institutions dealmaking is at an 18 year high but banking consolidation is elusive

-

Santander's popular dual tranche deal could spur others to follow, but flood of trades is unlikely

-

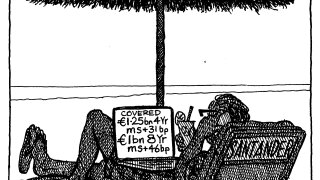

◆ Deal attracts more than €10bn ◆ Rarity of name and jurisdiction fuels demand ◆ No premium needed to take size

-

◆ Subordinated bonds proliferate as ceasefire talks buoy investors ◆ Nomura follows BNP Paribas with dollar AT1 ◆ BPM compresses T2 spread as PBB prepares to refi

-

◆ Takes larger size than expected ◆ Tightens 3bp to leave minimal premium ◆ French issuers fairly well funded before the summer