Santander

-

◆ Hesse prints largest European regional green bond ◆ ESM builds 'massive' book ◆ CDP tightens pricing by 6bp

-

◆ IDA fair value more art than science ◆ MuniFin gets over 140 accounts in its book ◆ Madrid makes debut EuGB trade

-

◆ 'Special trade' for the Dutch agency ◆ Bankers agree on NIP ◆ AIIB trade gives demand signal

-

◆ Deal attracts largest SSA book since Feb ◆ Issuer follows usual pattern ◆ Strong macro, interesting RV

-

◆ 'Modestly-sized' first syndication for FY 2025-26 ◆ Size balanced for secondary performance and liquidity ◆ DMO aims for consistency and predictability

-

◆ New deals land close to, if not at, fair value ◆ Book attrition visible amid competing corporate supply ◆ Seemingly no rivalry between senior FIG deals

-

◆ QTC inaugural deal could 'open doors' ◆ Bank treasuries supporting 0% RW names ◆ NWB opts for sterling alongside CAF

-

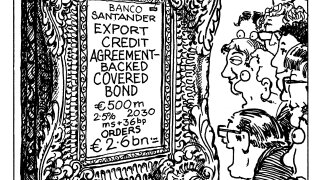

◆ Bond secured against a pool of export credit agreements ◆ Santander gets biggest bid-to-cover ratio since March ◆ Deal lands flat, if not through, fair value

-

◆ Level set at fair value, price not tightened ◆ French agency follows on in same maturity ◆ Books of under €1bn

-

◆ Four issuers out in dollars, three in the same maturity ◆ Swap spread moves foil tightening potential ◆ Deals getting done, but market isn't 'white hot'

-

◆ Three banks raise dollar funding with single digit premium ◆ ING moved through 'right window' to issue its first Yankee of year ◆ NatWest opts for four-part opco print

-

◆ FRN bullets favoured over callables ◆ Fixed leg targeted 'sweet spot' for investors ◆ Consensus on premium paid