Portugal

-

Caixabank’s plans to acquire Banco BPI will damage the issuer’s solvency and Moody’s has put the issuer rating on negative watch. Though the rating of both its mortgage and public sector covered bonds will also be dragged down, planned changes to rating agency’s methodology should ultimately mean the ratings end up unchanged.

-

The larger than expected quantitative easing programme announced by the European Central Bank on Thursday has turbo-charged the well-established bull flattening trend in covered bonds and trading volumes have tripled from earlier in the week. With the long end of French market now offering a tempting spread to OATs, real money buyers are set to return. And with Bonos and BTPs rallying hard, relative value between covered bonds and sovereigns should soon be restored in the Cédulas and Obbligazioni Bancarie Garantite markets.

-

Portugal’s Caixa Geral de Depósitos (CGD) issued a €1bn seven year covered bond, the longest seen from any Portuguese issuer in four years. And at 1% it was also the lowest coupon ever paid by a Portuguese covered bond issuer. The comfortably oversubscribed deal offered a new issue premium of 3bp to 4bp. However, rival bankers said the spread looked unattractive relative to government bonds which are should benefit from prospective central bank buying.

-

The national central banks of France, Portugal and Spain were reported buying covered bonds issued by banks from their own jurisdictions on Monday, said dealers. The amounts were small and the purchases were price sensitive, they added. Offers in Banca Monte Paschi Siena’s covered bonds were unchanged as its shares came under pressure following reports it may need to raise €1.7bn in fresh capital.

-

Banco Espirito Santo’s outstanding covered bond is bid only, and though little flow has been reported, dealers believe the offer is likely to be as much as 100bp tighter. In other news, Caffil’s bonds have performed well over the past month, outperforming the rest of the jurisdiction, partly driven by a new French law that limits the firm's litigation exposure by €66m which will considerably reduce the probability of a covered bond payment disruption.

-

232 people have responded so far to The Cover’s 2014 awards survey with as many as half being investors. The final results will be revealed in late September, but the preliminary outcome based on the un-weighted vote shows that the margin separating the top institutions and deals is thin in many categories, including prestigious awards such as Best Global House.

-

Covered bonds are likely to be so well ring-fenced from a regulatory perspective compared to other forms of bank debt that it makes sense to delink the asset class from the rest of the bank credit universe, a major investor told The Cover on Thursday.

-

Moody’s upgrade of Portugal last Friday bodes well for the prospective upgrade of the covered bonds issued by Santander Totta, said analysts on Monday. It should also help to limit covered bond contagion spreading to other lenders, in the event of further negative headlines emerging related to the troubled Portuguese lender, Banco Espirito Santo (BES).

-

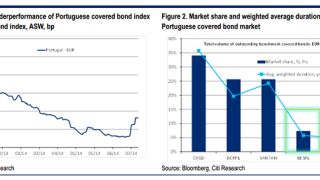

Pimco, after staying clear of Portuguese bank or sovereign debt for five years — was in Lisbon recently to investigate opportunities in the troubled peripheral jurisdiction generated by the ongoing Banco Espirito Santo (BES) headlines. The meetings came as several sell-side research analysts tipped Portuguese covered bonds as a good relative value opportunity versus periphery peers.

-

The focus of activity in covered bonds was squarely on Banco Espirito Santo on Tuesday morning with bankers reporting that its one outstanding publicly placed covered bond had widened by 25bp from last Friday. In contrast to the bank’s subordinated debt, which risks being completely wiped out, there is a strong expectation its covered bonds will be fully redeemed on time. However, further mark to market pressure is likely. With Portugal on review for an upgrade, the covered bonds of Santander Totta and CGD present value.

-

Bankers expect more bad news to come out of Portugal and the correction being seen in peripheral covered bonds may therefore have further to go. But this bad news fundamentally does not change the positive longer term picture for the rest of peripheral Europe. A technical retracement had been long overdue and will provide a rare buying opportunity for real money investors and banks looking to cover their shorts.

-

Banco Santander Totta surprised the market on Tuesday, announcing a mandate and setting initial price thoughts for a new five year benchmark of undetermined size.