KfW

-

KfW announced on Monday what is expected to be the stand-out deal of the week in euros — a 10 year benchmark.

-

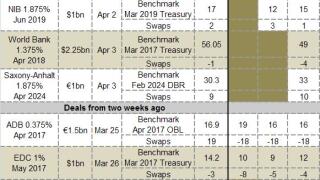

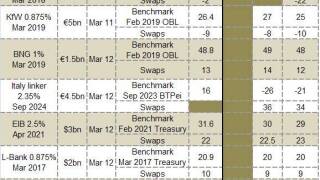

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

Kingdom of Sweden began sounding investors on Tuesday afternoon for a three year dollar mandate that could have the tightest spread to swaps of the year so far. Elsewhere, Japan Bank for International Cooperation hired banks for a dual tranche issue tapping five and 10 year demand.

-

Volatility across credit markets on Monday morning and late last week did not put core SSA issuers off from mandating for deals in dollars and euros — nor did heavy supply last week. A trio of issuers mandated banks on Monday afternoon for syndications in the wake of $7bn and €15bn of benchmark supply last week.

-

The Asian Development Bank will sell its first Kangaroo bond of 2014 on Thursday. Searing demand for the five year fixed and floating rate paper, driven in part by ADB’s rarity, means the issuer is likely to sell the largest Kangaroo trade since the opening month of 2013.

-

This week SSA Markets provides funding updates on key European supranationals and agencies. Click here to find out which issuers have completed over half of their 2014 funding requirements.

-

Rentenbank sold more than double its minimum target with a long dated Kauri deal on Thursday, highlighting diverse demand for bonds denominated in the currency. The European Investment Bank and KfW also seized on investor demand for long dated paper, selling 10 year Kangaroo taps.

-

KfW became the first issuer to sell Frankfurt listed renminbi debt on Tuesday, when it printed two year notes. The deal is the latest step in Frankfurt’s bid to become Europe’s main centre for renminbi business. Bankers expect other issuers to follow KfW’s lead.

-

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

This week SSA Markets provides funding updates on key European supranationals and agencies as we near the end of the first quarter. Click here to find out which issuers have completed nearly half of their 2014 funding requirements.

-

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.