KfW

-

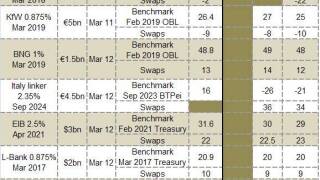

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

The European Investment Bank is set to break new ground in the green bond market after mandating banks for a six year Climate Awareness Bond on Tuesday — the first time a public sector issuer has attempted to print a green bond in the currency.

-

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

KfW will sell a tap of four year Kangaroo bonds on Wednesday, keeping non-core dollar supply steady following Kommunalbanken’s five year Kauri trade, priced on Tuesday.

-

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

Cades took to the dollar market on Thursday, selling a rare 10 year print. The issuer was inspired to sell the tricky maturity by a strong market this week and was rewarded with almost $4bn of orders.

-

Cades and KfW were the latest issuers to add to a flood of dollar issuance on Wednesday afternoon, hiring banks for a 10 year and four year deal respectively. The European Investment Bank and L-Bank both enjoyed solid demand for benchmarks of their own on Wednesday.

-

Belgium mandated banks for a new June 2034 euro benchmark on Monday, adding to a euro pipeline that already included a mandate from KfW earlier in the day and an expected deal from the European Financial Stability Facility later in the week.

-

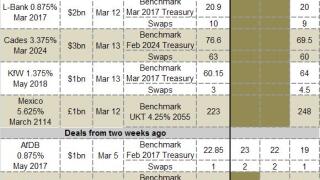

Read on to see how deals priced earlier in the year are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

This week SSA Markets provides funding updates on key European supranationals and agencies after what is traditionally the busiest issuance period of the year. Click here to find out which issuer has completed over 30% of its 2014 funding requirement.

-

Erste Abwicklungsanstalt has hired banks to run a three year dollar benchmark — its first fixed rate benchmark in the currency — as leads on a deal in the same tenor for KfW were busy dealing with a book of over $7bn for a print capped at $4bn.

-

World Bank enjoyed searing demand on Wednesday for its first Kauri trade of the year, a five year note. Interest from a wide geographical base allowed the issuer to print the second largest trade ever in the format.