KfW

-

Belgium and KfW received well oversubscribed order books for 10 year euro benchmarks on Tuesday, with several public sector borrowers set to follow in the euro market this week.

-

The European Financial Stability Facility rebooted the euro public sector market on Monday with an intraday execution ahead of what SSA bankers expect to be a busy week for supply. Belgium and KfW are already on screens for benchmark trades in the 10 year part of the curve.

-

KfW has appointed a senior funding manager to its new issues team in Frankfurt, with responsibility for sterling and dollar deals.

-

Issuers are flocking to the sterling bond market ahead of the crunch vote in the UK Parliament on prime minister Theresa May’s Brexit deal, which is scheduled for January 14. Issuers are taking full advantage of a parliamentary recess and a break in the political mayhem that saw the vote, originally due to take place last month, postponed due to May's fears it would be voted down. Burhan Khadbai and Tyler Davies report.

-

-

The European Investment Bank and KfW comfortably raised a combined £2.25bn on Thursday after receiving whopping investor demand for benchmark trades. This Friday is set to add to the sterling glut, with deals from the Asian Development Bank, Bank Nederlandse Gemeenten and Swedish Export Credit Corporation.

-

Secondary spreads in the euro public sector market have widened ahead of an expected flurry of benchmark issuance next week, with several issuers set to tap the market, according to SSA bankers.

-

KfW and the European Investment Bank mandated banks on Wednesday for the first sterling SSA deals of the year. Public sector borrowers are looking to pile into the sterling market before the crunch vote by the UK Parliament on Theresa May’s Brexit deal in mid-January, with deals expected in both Sonia-linked and fixed rate formats.

-

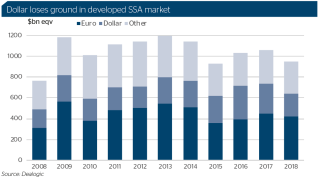

SSA euro issuance outstripped dollars this year, thanks to strong conditions in the first half and the vagaries of the basis swap. But the end of eurozone quantitative easing and political strife made it a trickier place later in 2018 — and those elements are unlikely to disappear in 2019.

-

Public sector borrowers are confident going into the euro bond market next year, with reinvestments from maturing bonds held by the European Central Bank likely to cap any spread widening from the end of quantitative easing. But political threats — from populists polling well ahead of European Parliament elections in May, Brexit probably in March and the Italian government’s stand-off with the European Commission over its budget plans — are likely to bring volatility, meaning timing will perhaps be more important than in 2018. GlobalCapital brought together European SSAs, investors and investment bankers to discuss what 2019 holds for the euro market — as well as the SRI sector and new technology.

-

The dollar SSA market at the end of 2018 was in stark contrast to euros, despite the latter outstripping it in volume over the year. Even uncertainty over the Federal Reserve’s rate path in 2019 seems unlikely to shake the fortitude of the currency as a funding source for SSAs. But finding windows could become trickier as the Fed pulls liquidity amid global trade wars and rising populism.

-

In the last year that sovereigns, supranationals and agencies could enjoy the effects of the European Central Bank’s quantitative easing programme — but still had to cope with the Fed pushing up rates — GlobalCapital’s SSA team used its editorial judgement, with inspiration from GC’s world-famous bond comments and patented BondMarker app, to pick what it felt were the top trades of the year. The team strove to find deals that were not just the biggest — it looked for trades that set pricing markers, were innovative and brave or that made an impression in other ways. GC presents the winners here. Congratulations to the issuers and banks involved.