HSBC

-

Bankers fired when HSBC closed its European M&A and ECM business at the start of the year are resurfacing as big banks plug holes and target mid-market deals

-

Bank recruits three for public sector debt capital markets, another to move out to Middle East

-

Third Saudi capital markets banker to leave in recent months

-

◆ Old tier two call date approaches ◆ Tier two pick-up over senior gets tighter ◆ Wide range of feedback but ‘can’t compare this to anything’

-

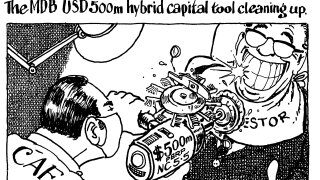

Bank intends to issue more hybrid capital but ‘more MDBs need to print’ for new asset class to grow further

-

Issuer aims to stay active in core maturities and has now done three and 10 years in 2025

-

◆ LatAm development bank adds to funding toolkit ◆ Patience is virtue as issuer waits out tariff storm ◆ Book ended up 6.4 times covered

-

◆ Hesse prints largest European regional green bond ◆ ESM builds 'massive' book ◆ CDP tightens pricing by 6bp

-

◆ Bank regains access to euro covered bonds after selling previous issuers ◆ Deal prices in line with Australian and Canadian paper... ◆... allaying concerns about LCR eligibility

-

HSBC doubles down with first Yankee AT1 deals for three months

-

European banks progress with capital raising as spreads tighten, but investor qualms grow

-

HSBC has set the plan for its slimmed-down investment bank, but the model is untested — and was not designed by those who will implement it