Zambia

-

Support from Chinese creditors was a big step forward in a process which has been conducted at a glacial pace

-

China's support means a deal could be agreed by year-end

-

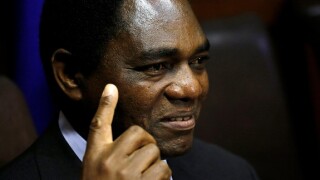

Restructuring of emerging market debt is back on the agenda this week, as defaulted Zambia’s election saw ‘market friendly’ Hakainde Hichilema secure the country’s presidency. The nature of its forthcoming Eurobond restructuring, which some say could act as a benchmark for other emerging market sovereigns, is expected to become clear within weeks

-

Hichilema victory surprises bond investors with new government expected to be more market friendly

-

Ethiopia has been hit with another downgrade by Moody’s, as a lack of clarity over its request to use the G20 Common Framework for debt restructuring clouds its market prospects. The outlook for sub-Saharan African financing remains rocky, as criticisms linger over the funding on offer.

-

The IMF and Zambia have reached a "broad agreement" on a reform agenda for Africa’s first sovereign defaulter of the pandemic era. That will serve as a prelude to securing a new credit facility from the Fund and pleased investors, who noted that Zambia's bonds have made gains in recent weeks.

-

The announcement this week that the IMF is on its way to issuing a further $650bn of special drawing rights, providing central banks with extra foreign currency liquidity, should not be criticised for being too little, too late. It marks a much needed return to multilateralism, something that the developing world will benefit from.

-

Zambia and the IMF will resume negotiations on an extended credit facility package, having missed the first deadline.

-

The IMF and Zambia will continue their negotiations about a package to put the country on a path to financial stability, the Fund said on Thursday, after the deadline for initial talks had passed the day before with no deal agreed. But market participants are still demanding more transparency over the defaulted sovereign's external debts.

-

The Ivory Coast sought to raise some extra euro cash by tapping bonds in euros on Monday but, with two African sovereigns requesting debt restructuring support from the G20 over the last week, some market participants have begun to question the continent's borrowers.

-

Zambia, which months ago became Africa’s first sovereign default since the pandemic started, has requested debt treatment under the G20’s Common Framework. That makes it the third African sovereign to request restructuring support under the guidelines, which were first announced in November.

-

Zambia has become Africa’s first sovereign to default since the coronavirus started, after it failed to make payments on its Eurobonds. The heavily indebted country now faces a rocky path to debt restructuring, market sources said.