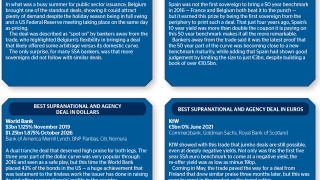

World Bank

-

One of the busiest days ever in the public sector dollar market ended with five issuers sitting on deals printed at the top end of their size targets and with pricing tightened from initial thoughts. Another borrower is already out for Thursday business and bankers predict that conditions are so “incredible” that deal flow will stay healthy into next week — no matter what policy statements incoming US president Donald Trump makes at his inauguration on Friday.

-

Public sector borrowers may have to compete for demand this week with Wednesday looking likely to be one of the busiest days of the year.

-

A quartet of public sector borrowers are set to cram into the front end of the dollar curve on Wednesday, as bankers outlined a triple whammy of factors driving the squeeze.

-

The UK Debt Management Office has picked the maturity and timing for a scheduled bond sale later this month. Elsewhere in sterling, a pair of issuers added deals to a bumper opening week that fell just short of a record.

-

A remarkable sterling deal from the European Investment Bank sparked off a week that could become a record opener for supranational and agency issuance in the currency.

-

Searing conditions in the sterling market could lead to a record opening week of SSA issuance in the currency as a pair of issuers lined up deals for Friday — despite this only being a four day week.

-

As a year where political upsets became the norm drew to a close, GlobalCapital picks the standout trades from a turbulent 2016.

-

The International Development Association will begin to issue international bonds as part of a large scale-up of its activities.

-

World Bank added an A$75m ($56.2m) tap to its November 2031 Australian dollar bond on Tuesday. The original bond was the first time an SSA had printed a Kangaroo benchmark that far out along the curve.

-

World Bank added a A$75m ($56.2m) tap to its November 2031 Australian dollar bond on Tuesday. The original bond was the first time an SSA had printed a Kangaroo benchmark that far out the curve.

-

The African Development Bank printed the longest green bond in the history of the Kangaroo market this Tuesday.

-

Appetite for 30 year callable zeroes in dollars has been bolstered by Donald Trump’s victory in the US elections and the resultant rise in bond yields around the world.