US election 2016

-

Leading US financial institutions were quick to condemn the shocking attacks on the US Capitol on Wednesday — a sign that they are willing to take positions on important social issues, in line with the industry’s eagerness to align with good environmental, social and governance standards.

-

Equity capital markets bankers and investors are finally starting to put their feet up at the end of a historic but tumultuous year. Issuance has been at the forefront of the economic response to the coronavirus after being shuttered by the initial pandemic sell-off with innovation and perseverance ensuring that companies had the funds to survive. In order to mark the end of 2020, GlobalCapital looks back on some of the most noteworthy events and deals.

-

Three banks launched new senior deals in euros on Monday, taking advantage of a jubilant tone in the market following Joe Biden’s victory in the US presidential election. That sentiment received a further boost during the morning trading session when Pfizer and BioNTech revealed successful Covid-19 vaccine trials.

-

The US presidential race was still on a razor’s edge as GlobalCapital went to press on Thursday. The US political landscape — and with it, the trajectory of the capital markets — looked set to unfold in individual voting districts over the coming hours and days. But soon, the focus will broaden once more and investors will attempt to map out their long-term view of where to place their money, write Lewis McLellan, Sam Kerr, Mariam Meskin and Oliver West.

-

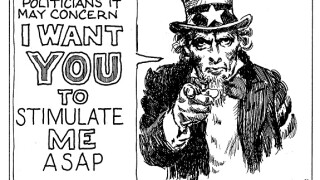

Just because it seems unlikely that in the US election the Democrats will take both the White House and the Senate, it does not mean that capital markets should become despondent about a fiscal stimulus package that could have reached $2.3tr had the so-called "blue wave" made a clean sweep.

-

Capital markets bankers are preparing to restart issuance next week to take advantage of a rally should Joe Biden be confirmed as president-elect of the US by the end of this week, write Sam Kerr, Tyler Davies, Oliver West, Mariam Meskin, Michael Turner and Lewis McLellan

-

Asia’s dollar bond issuers hit pause this week as all eyes turned to the outcome of the nail-bitingly close US presidential election. With the result still uncertain on Thursday, but signs showing a Joe Biden victory as a possibility, some bankers in the region reckon the debt market may be at full throttle from next week. Morgan Davis reports.

-

Germany found lacklustre demand for its second ever green bond on Wednesday. The sovereign had to contend with a big drop in Bund yields following uncertainty over the US election result.

-

Global equity markets have reversed earlier losses after former US vice-president Joe Biden gained momentum in the presidential race on Wednesday afternoon, giving capital markets bankers hope that a decisive result this week might be possible.

-

The eventual result of Tuesday's US presidential election could have a monumental impact on the position of key emerging markets states like Russia and Turkey in the international arena.

-

The US presidential election result was far from clear on Wednesday morning but, while uncertainty is never a popular result, the SSA market is unlikely to be derailed for long.

-

Convertible bond investors are preparing for elevated levels of volatility in the wake of the extremely close US election results, but many are waiting for more results in key states before taking a view on the direction of the market.