US dollar

-

Bankers hope Fed meeting opens window for EM bond issuancce

-

◆ Investors hungry for first 10 year deal since early February ◆ 'High quality' book allows for strong price revision ◆ Slim premium paid

-

Deal was among MDB bonds warmly welcomed by investors this week

-

High volumes issued as bond market pushes through geopolitics

-

◆ Pace of FIG issuance in the US slows down ◆ Nordea the sole Yankee financial issuer this week ◆ Local insurers make up the rest of the primary action with senior and subordinated offerings

-

Pragmatism to the fore for issuers trying to price benchmarks in turbulent markets

-

◆ First new benchmark from the issuer in two months ◆ Record IOIs but pragmatism remains ◆ Investors welcome MDBs back in primary after recent Trump noise

-

Canada's strong dollar deal suggests investors are looking beyond Trump threats

-

Issuance volumes in the region were far, far higher than any previous February

-

◆ First MDB in fixed rate dollars since February ◆ ‘Someone has to’ reopen the market ◆ Investors in ‘wait-and-see’ on US’ involvement in MDBs

-

◆ Bankers say deal was postponed ◆ Book covers size four times ◆ 'Safety first' in current environment

-

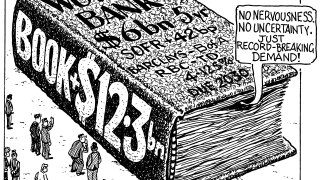

◆ New five year bigger than planned ◆ New dollar book record for sovereign ◆ Rare but regular issuer, 'a pleasure' of a deal