US dollar

-

◆ ADB, KBN, OeKB price bonds ◆ Spreads to Treasuries in the spotlight ◆ Big books for all

-

The Kazakh bank is the fifth largest bank in the country as measured by assets

-

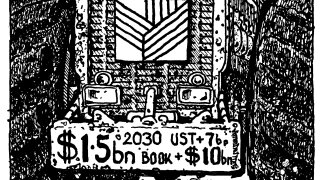

◆ Biggest book for Rentenbank in any currency, according to lead ◆ Agency raises $1.5bn ◆ Sets stage for more dollar issuance

-

The financing marks the bank’s first Islamic syndicated transaction in the international market

-

Issuers having second thoughts about mandating for dollar bonds while euro and sterling issuance charges ahead

-

◆ Issuer achieves cover ratio record ◆ Other markets in play for remaining $3bn needs ◆ More SSA dollar issuance to come

-

-

Tightening trend in private credit pricing has reversed since April 2, but reliability is funds' trump card

-

-

Diversity of deals on offer as recession fears subside

-

What is good for equity markets may be bad for Treasuries

-

Federal Reserve kept rates steady but only one company emerged after FOMC meeting