US dollar

-

-

The energy and commodities company saw significant enough interest during syndication to increase deal size

-

EIB, already 80%-funded for the full-year, will bring another dollar deal on Tuesday

-

Province ‘well within comfort zone’ with borrowing target despite enlarged deficit

-

Second aircraft lease master trust deal tightens 20bp from IPTs to guidance

-

US corporates continue to enjoy decent funding conditions

-

◆ Yankee banks top up regulatory capital ◆ Brown & Brown fund $10bn acquisition ◆ Investors hunt for yield

-

◆ First dollar benchmark of 2025 ◆ Tight spread to US Treasuries like peers ◆ Large book supports 4bp tightening

-

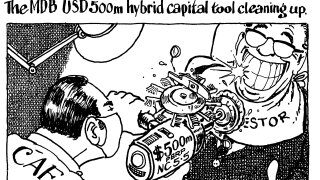

Bank intends to issue more hybrid capital but ‘more MDBs need to print’ for new asset class to grow further

-

Longer tranches added during syndication off back of lender demand

-

◆ LatAm development bank adds to funding toolkit ◆ Patience is virtue as issuer waits out tariff storm ◆ Book ended up 6.4 times covered

-

Funding strategy evolves as borrowing needs swell and investor base expands