United States

-

Public sector funding options less sure after swap spread gyrations and hit to confidence in US

-

Three headed to market on Thursday

-

By plunging the US into a recession, Trump might get his rate cut wish

-

Corporates cram into dollars before tariff day

-

Next major day for US primary FIG is April 11 — JP Morgan's earnings, which typically heralds heavy new supply

-

Trump has been far more open to negotiation on tariffs than expected, said one EM fund manager

-

Severn Trent and Bank Vontobel tempt investors with inaugural trades

-

Canadian banks cross the border and UOB makes rare return to the US before tariffs imposition

-

◆ Three banks raise dollar funding with single digit premium ◆ ING moved through 'right window' to issue its first Yankee of year ◆ NatWest opts for four-part opco print

-

European companies happy to pay up for size

-

◆ Pace of FIG issuance in the US slows down ◆ Nordea the sole Yankee financial issuer this week ◆ Local insurers make up the rest of the primary action with senior and subordinated offerings

-

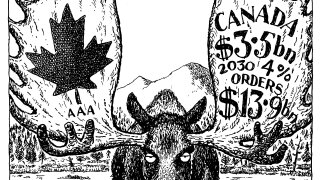

Canada's strong dollar deal suggests investors are looking beyond Trump threats