United States

-

Safe senior bonds are all well and good — but refinancing capital will show just how far investors' appetite for property-heavy banks goes

-

Company makes easy work of a market missing deals

-

◆ BFCM becomes first French bank to print Yankee after parliamentary election ◆ Foreign banks rush before major US peers expected to swarm market ◆ Athene raises dollars days before pulling a euro deal

-

Issuers both land big books as market quickly shrugs off French election volatility

-

As supply becomes scarcer, it will be easier for companies to sell dirty debt as green

-

◆ Foreign FIG issuance so far in 2024 outstrips last year’s volume by more than $20bn ◆ Multiple Canadian and Japanese lenders print ◆ US banks prepare capital plans after the Fed’s latest stress tests

-

Highly rated names land smooth trades after investor demand showed signs of weakness for corporates last week

-

Issuer cannot tighten from initial price thoughts as market remains hostile to lesser known names

-

US medtech firm sourced more than half of $4.2bn debt needed in the €1.8bn trade

-

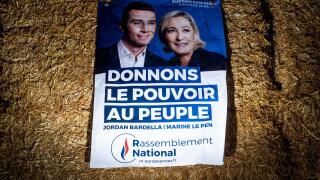

European markets need to prepare for six months of politically-driven market volatility

-

Borrowers cram in before what could be the first ECB rate cut since 2019

-

◆ Market volatility no hindrance for foreign and domestic FIG issuers ◆ They take advantage of favourable conditions ◆ May volume to end more than 80% higher compared with a year ago