United Arab Emirates

-

The trades drew big order books and each issuer was able to crunch pricing by tens of basis points

-

Abu Dhabi's state oil company's privatisation drive continues with its logistics division

-

More Gulf issuers readying deals for after Eid

-

The book passed over $1bn and included international accounts as well as the usual Islamic buyers

-

Listings by privately owned companies are expected to play a greater role in the Middle Eastern IPO market this year

-

Big demand for UAE deal as IPO issuance from the Middle East overtakes Europe once again

-

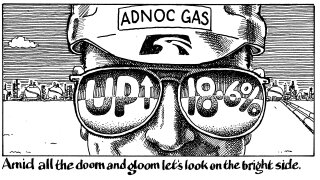

Adnoc Gas and Abraj Energy surge in early trading as global equities plummet

-

Currency exchange house secures $54m cornerstone bid from National Bonds Corp

-

Biggest ever Abu Dhabi IPO defies jitters after SVB collapse

-

The UAE exchange house could aim for a valuation of up to $2.75bn, market sources suggest

-

The lender offered investors a spread of nearly 200bp to the Emirate of Sharjah, said a lead bank

-

Demand was strong, but bankers concerned about flotation of Abraj, to be priced on Monday