UniCredit

-

◆ Domestic and international investors split over price ◆ Final spread strikes balance between differing spread opinions ◆ Debut deal attracts highly granular book

-

Hesse takes €1bn after investors flock to Land NRW, Saxony-Anhalt and Land Baden-Württemberg

-

German federal state attracts nearly €3bn of demand for inaugural social bond

-

Two German issuers each took planned €500m from oversubscribed books on the same day as the sovereign

-

Subscription ratio ends strong despite slow start to book building

-

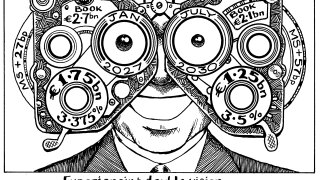

UniCredit's Czech and Slovakian entity readies the tried and tested: capped green foray at the belly of the curve

-

ThyssenKrupp and De Nora to float on-trend green hydrogen JV in all-primary deal

-

UniCredit Italy sets a strong precedent many of its national peers plan to follow

-

The appointment was head of origination for the Nordics, UK and Ireland at HypoVereinsbank

-

Crédit Agricole Italia and other Italian issuers to follow

-

◆ UniCredit to end seven year absence from OBG mart ◆ More Italian deals set to follow ◆ Deal to offer RV compared to paper from more liquid jurisdictions

-

Yachtmaker’s Chinese shareholder floated Ferretti in Hong Kong to get a better valuation