UniCredit

-

Compagnie Générale des Etablissements Michelin, the French tyre company, won more than €10bn of demand for its €1.5bn bond issue on Monday. Now a growing number of corporate bankers expect to see European high grade spreads return to pre-Covid 19 levels.

-

The European Investment Bank hit screens on Monday afternoon to announce what will be its final benchmark deal of the year, with the issuer set to use every inch of its €70bn borrowing authorisation for 2020.

-

-

-

Three banks rode out a volatile bond market this week, printing senior deals amid positive sentiment caused by talks making it seem an agreement about a new US Covid-19 stimulus package was closer on Tuesday.

-

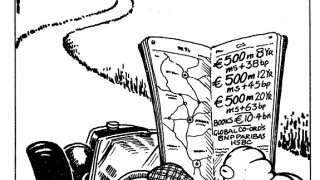

Iberdrola, the Spanish energy utility, launched a €3bn dual tranche hybrid capital bond on Wednesday, as syndicate bankers say the hunt for yield is encouraging issuers to push boundaries on the amounts they raise in hybrid issues.

-

A pair of banks made opportunistic moves into a euro market buoyed by positive headlines around a potential US stimulus bill on Wednesday. France’s Crédit Mutuel Arkéa and Japan’s Sumitomo Mitsui Financial Group each tapped for senior paper, raising €500m a piece.

-

Michelin, the French tyre maker, has signed a €2.5bn sustainability-linked revolving credit facility with a three year maturity, as loans bankers say the market has become more nuanced towards maturities since the onset of Covid-19 made many of them tighten terms.

-

UnipolSai Assicurazioni was nearly three times subscribed for a restricted tier one (RT1) this week — the first of its kind in Italy. An attractive coupon helped to offset any concerns about Italian sovereign risk or a lack of liquidity in the RT1 market.

-

Criteria Caixa is sounding out investors for a new seven year unsecured euro bond: its first at this tenor in over five years.

-

The European Union impressed as it sold its highly anticipated debut syndicated bond under its Support to Mitigate Unemployment Risks in an Emergency (SURE) funding programme on Tuesday, with the deal receiving record breaking demand at minimal new issue premiums.