UniCredit

-

◆ Joint Länder trade raises €1bn ◆ JLMs help cover deal ◆ EGB sell-off deepens

-

◆ Strong market for subordinated bank debt in euros and dollars ◆ Investors buy ‘undersupplied’ UniCredit AT1 at multi-year low yield in the asset class ◆ Barclays, SMFG and ENBD target dollar AT1 buyers

-

◆ Prices 15bp through peer ◆ Fair value not easy to calculate ◆ IFB Hamburg prints too

-

◆ Rare Portuguese issuer lands very close to Pfandbrief ◆ Tightening in covered bond spreads prompts divergent views on where fair values are ◆ Both issuers fund close, if not flat to, perceived fair values

-

◆ NRW.Bank opens euro account ◆ WIBank flat to fair value ◆ Saxony-Anhalt tightens

-

◆ 'Good outcome' for German states ◆ Spread to KfW tighter for longer maturities ◆ Prices tighter than 10 year deals from peers

-

◆ German Land's issue sets new record ◆ Yield, spreads both attracted ◆ Both real and fast money keen to get paper

-

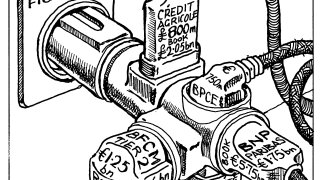

Warm reception for French banks in euros and other currencies shows FIG market is in positive health

-

◆ Italian bank overcomes slower day in primary with first FIG dual tranche deal of year ◆ Why issuer chose twin tranches ◆ Concession discussed

-

◆ Third year in a row when issuer priced on first day ◆ Large size, reasonable pricing, ‘encouraging deal’ ◆ Spread over KfW held key to pricing

-

European investment banks are playing catch-up, even on home turf. Which of them are best placed to challenge the US leaders?

-

◆ 'Investors seem to be buying' in euros ◆ Institutional community's tap tightened 4bp ◆ Deal’s coverage ratio was issuer's highest this year