UK

-

The company announced his departure on Friday

-

Severn Trent and Bank Vontobel tempt investors with inaugural trades

-

-

Shift to shorter Gilts as UK gets ready to borrow £304bn in 2025-26

-

Regulator changes direction after years of 'allergy to risk'

-

Company is refinancing to cut costs

-

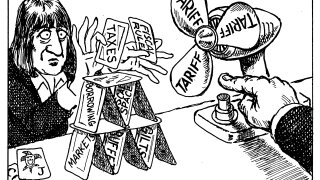

Borrowing task is second largest ever after Covid response

-

◆ Borrowers take £500m from undersupplied market ◆ Despite lower spread Northern Powergrid's longer maturity trade more popular ◆ Sterling volumes down around 10% from March 2024

-

Real Gilt on blockchain will force market to address technical, legal and risk challenges

-

Rising defence spending to create opportunities for lenders

-

◆ Subscription ratio and spread move in line with recent deals ◆ Low single digit concession needed ◆ Small premium paid over sterling

-

The solar energy investment company slashes 30bp off part of its loan margin