UBS

-

Nearly three years after its reboot, UniCredit’s corporate finance business is starting to motor as Andrea Orcel’s performance-led ethos yields results

-

Swissie market offering pricing benefits to issuers willing to go longer

-

One month marketing period begins on Thursday ahead of a 10 year issuance

-

◆ Diverse set of issuers to fund before the ECB on Thursday ◆ Jefferies prepares rare euro deal ◆ Despite rates volatility, the market is open

-

Swiss franc bond investors take lower interest rates in their stride as hunt for duration continues

-

Bank takes Morgan Stanley executive director to lead SSA charge

-

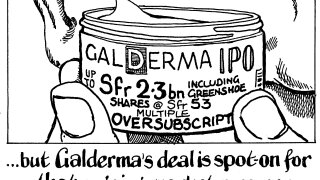

The biggest IPO of 2024 so far in Europe has delivered a welcome bounce in the aftermarket

-

Michael Klein’s attempted spin-off of Credit Suisse’s investment bank was complex and conflicted, but it could have reshaped the landscape in a way the UBS takeover does not

-

The German cosmetics retailer fell over 7% below its IPO price on the first day of trading

-

The final size of the base deal will be Sfr2bn after the IPO was priced at the top of the range

-

Douglas is expected to achieve a multiple of 6.1-6.3 times its 2024 Ebitda

-

The biggest IPO of the year so far in Europe is multiple times covered, according to sources