Thailand

-

CP Pokphand Co, the Hong Kong-listed investment arm of Thailand’s Charoen Pokphand Foods, has closed a $400m loan for refinancing with 15 lenders.

-

Asian Development Bank offloaded chunks of Thai energy companies B.Grimm Power and Gulf Energy Development this week, raising Bt9.6bn ($303.9m).

-

CPF Investments, a unit of Thai firm Charoen Pokphand Foods, has returned to the loan market for a refinancing of up to $1bn.

-

Thai oil and gas company PTT Public Co sold the first 50 year bond from an Asian corporation on Thursday, raising $700m from a tightly-priced deal.

-

Sri Trang Gloves priced its Bt15bn ($481.4m) Thai IPO at the top of the range this week, taking advantage of coronavirus-driven demand, strong international interest and a liquid domestic equity capital market. Jonathan Breen reports.

-

Thai rubber glove maker Sri Trang Gloves is set to raise Bt14.9bn ($481.4m) from its IPO, capitalising on a surge in demand for its products caused by Covid-19.

-

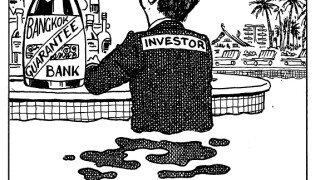

Thai hospitality company Minor International (Mint) used a guarantee from Bangkok Bank to issue a $300m bond this week. The deal structure, which echoes its 2018 debut bond, helped quell investor concerns about how Covid-19 has ravaged the borrower’s business. Morgan Davis reports.

-

The strong response from banks to Charoen Pokphand Group’s acquisition-related loan is not a true reflection of conditions in Asia’s syndications market — despite what some may say.

-

Thai Oil Public Co managed to raise $1bn from a dual-tranche bond by the ‘skin of its teeth’ on Thursday, tightening price guidance twice during bookbuilding to find the right groups of investors.

-

Thailand’s PTT Exploration and Production Public Co (PTTEP) found strong support for its $500m seven year bond on Thursday, despite an aggressive price tightening during bookbuilding.

-

Charoen Pokphand Group has launched a $7.15bn-equivalent loan into general syndication after attracting five banks at the senior level.

-

Sino Biopharmaceutical’s shares tumbled about 8% on Tuesday after its chief executive officer, Tse Ping, sold a portion of his stake in the company for HK$2.27bn ($292.9m).