Switzerland

-

Swiss franc bond investors take lower interest rates in their stride as hunt for duration continues

-

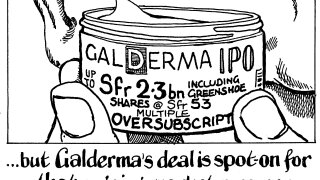

The biggest IPO of 2024 so far in Europe has delivered a welcome bounce in the aftermarket

-

The final size of the base deal will be Sfr2bn after the IPO was priced at the top of the range

-

Private bank issued the largest single tranche by a domestic institution since 2020

-

The biggest IPO of the year so far in Europe is multiple times covered, according to sources

-

Demand for domestic covered bonds drives strong outcomes for issuers

-

Long delayed listing of Nestlé's former skincare division is finally underway

-

Swiss bank expected to offer a pick-up over other non-eurozone names

-

Swiss utility secures extended funding and new lenders with deal linked to three KPIs

-

MUFG Bank is looking to grow financial institutions coverage in Europe

-

Constant inflows help Coca-Cola HBC, Ren and Enel snap spreads in during bookbuilding

-

The block on Monday night raised Sfr146.7m for Kirkbi Invest, the investment company of the Kristiansen family