Swedbank

-

The European Securities and Markets Authority on Monday issued fines to five banks from the Nordic region totalling €2.475m, for issuing credit ratings without having gained the necessary approval.

-

Danske Bank has added two new members to its FIG origination team in Copenhagen.

-

Swedbank has grown its DCM syndicate team after hiring an SSA and FIG focused banker from a Nordic rival.

-

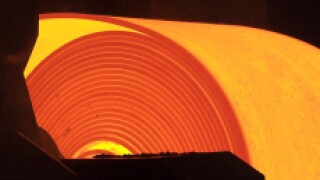

Sweden’s SSAB has ramped up the size of its euro denominated revolving credit facility to €600m, as the high strength steelmaker becomes the latest beneficiary of the liquidity flooding the loan markets.

-

Sweden’s Lundin Petroleum has slashed 90bp off the margin of its $5bn reserves-based lending facility, as borrowers continue to heap pressure on lenders over pricing.

-

Swedbank announced in its results on Tuesday that a proposal to change the regulatory treatment of Swedish mortgages would lower its common equity tier one (CET1) ratio. The rule change will also take Swedish banks’ additional tier one (AT1) bonds closer to their trigger levels.

-

D Carnegie & Co, Sweden's largest listed residential property developer, is raising capital through a rights issue to expand is investment and development opportunities.

-

The Basel III reforms will create a 4% capital shortfall across the banking sector that could be covered in close to three years, according to analysts at UBS.

-

Banks have ramped up their use of green senior bonds in the fourth quarter of 2017, with many of their latest offerings sporting fantastic results in terms of pricing. But, as Tyler Davies reports, European financial institutions have yet to mix the principles of green finance with the tenets of bank capital — an experiment that could be even more beneficial for everyone involved in the growing green bond market.

-

A debut green bond from Swedbank this week was the clearest indicator yet that green bonds can price more tightly and outperform the rest of the FIG debt market, including perhaps covered bonds, writes Jasper Cox.

-

-

Oslo-listed oil and gas exploration firm Aker BP raised Nkr4.1bn ($500m) through an accelerated bookbuild, to fund its acquisition of Hess Norge, the owner of two Norwegian oil fields.