Sterling

-

German issuer's return partly due to continuing volatility caused by the French election

-

◆ Issuer takes patient approach in volatile market ◆ First such deal in over a decade ◆ M&A adds complexity

-

UK companies head into undersupplied home market to land solid deals

-

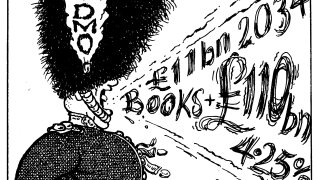

£110bn book proves ‘gradual but structural shift’ in demand to shorter tenors

-

'Textbook execution' lands sovereign issuer 'blowout deal'

-

◆ Bankers reveal size expectation ◆ UK lender's first deal since 2011 ◆ Time needed to re-introduce the issuer to investors

-

◆ Coventry Building Society orders reached £4bn ◆ Banco Santander finds price sensitive investors ◆ New issue premiums vary

-

Investors had their pick of unrated, smaller hybrid and sterling deals on day before ECB meeting

-

The sovereign wealth fund paid no concession, but a lead conceded fair value estimates will vary widely

-

◆ UK insurer prints inaugural dollar tier two a day after main sterling leg ◆ Achieves currency and investor diversification while meeting £750m funding target ◆ Revival in sterling FIG across capital structure

-

Demand was nearly £4bn for the sovereign wealth fund's first ever debut in a new currency

-

◆ Slim premium paid on chunky sale ◆ Investors welcome Canada pick-up to UK names ◆ Canadians missing from covered bonds