Sterling

-

◆ Lack of supply a factor ◆ Slim premium paid ◆ Domestic accounts accustomed to Gilt volatility and headlines

-

◆ Abundant demand for UK water credit ◆ Order book about three times deal size

-

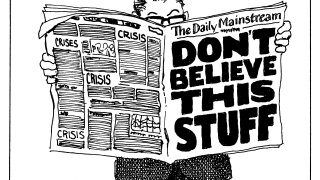

◆ Record Gilt and hot sterling bonds give the lie to ‘UK crisis’ chatter ◆ Emerging market bonds bask in rampant demand ◆ Qualms creep into public sector bonds as investors get choosy

-

Banks see opportunities in supporting direct lenders' ESG loan initiatives

-

◆ Possible record demand for first non-UK benchmark since PRA debacle in April ◆ Deal lands flat to fair value and euros ◆ Market hopes more names will follow

-

Issuers could find the next 12 weeks a lot easier than Rachel Reeves

-

Banks, corporates, even the government find eager buyers

-

◆ Strong demand for scarce housing paper ◆ Orders peak at 3.5 times deal size ◆ Long end Gilts recover after a turbulent week

-

DMO chief says 'broad-based demand' and 'strong international appetite' supported Gilt sale in tricky conditions

-

◆ Two deals in under a week reopen dormant market ◆ Société Générale prints smaller size in shaky market ◆ But cost comes flat to euros, says lead manager

-

◆ Near-record book of ‘exceptional’ quality ◆ Ten year tenor, fixed income inflows help demand

-

◆ Tight deal reprices new issue market ◆ Deal comes through Leeds ◆ Investors keen to pick up sterling covered paper