Standard Chartered

-

NatWest jumped into a dollar market in search of additional tier one (AT1) paper on Wednesday morning, as investors shrugged off short term volatility to open their "deep pockets".

-

Indian software services provider Coforge, previously known as NIIT Technologies, is seeking a loan to fund a dividend recapitalisation, joining a growing list of companies raising debt to pay a special dividend to shareholders.

-

The green dim sum bond market saw a small jump in action on Tuesday, with high yield issuer Zhenro Properties Group selling a short-dated deal and German development bank KfW reopening one of its existing notes.

-

BoCom International Holdings Co leaned on a hefty syndicate team to lock up a $500m five year bond on Tuesday.

-

Sino-Ocean Capital Holding has raised $500m from a two year bond. The deal was the company’s longest in the offshore market, but came with a weaker structure than its past outings.

-

-

-

The Republic of Turkey demonstrated its access to international markets this week with a four times oversubscribed sukuk. But the deal does not represent an access-all-areas pass to the capital markets for the borrower, following a turbulent period that has seen little change to appease investors, writes Mariam Meskin.

-

Standard Chartered's head of financial markets and financial market sales for continental Europe, Stephan Schrameier, is no longer with the bank.

-

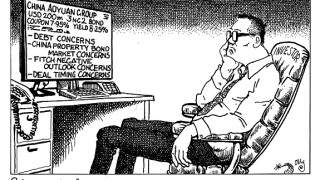

China Aoyuan Group’s attempt to woo investors to its $200m bond with a generous yield fell flat on Tuesday. Recent concerns about the property developer’s leverage, and the subsequent fall of its dollar bonds in the aftermarket, held investors back from the new deal — and caused a further spiral in secondary. Morgan Davis reports.

-

Snus tobacco and match producer Swedish Match has made a rare stop in the euro bond market to issue its first offshore deal of the year. Elsewhere, QNB Finance and First Abu Dhabi visited a pair of niche currencies.

-

Turkey's Akbank launched a dollar sustainable bond on Tuesday, just months after it raised its first ESG-linked syndicated loan.