Sri Lanka

-

The Monetary Board of the Central Bank of Sri Lanka has suspended the primary dealer status of Pan Asia Banking Corp (PABC) for six months.

-

Sri Lanka has reached its target of $1bn from a three year syndicated loan that was launched at $450m, after demand poured in from Indian lenders.

-

Indian banks are muscling into offshore loan syndications they previously rejected out of hand, driven by a desperate need to lend amid a slowdown in domestic borrowing. Shruti Chaturvedi reports.

-

An up to $1bn facility for the Sri Lankan sovereign has hit general syndication, about three months after the borrower mandated six banks for the deal.

-

The Democratic Socialist Republic of Sri Lanka wowed investors with its new 10 year outing, securing a massive $11bn order book for a $1.5bn deal.

-

The Democratic Socialist Republic of Sri Lanka opened books for a new dollar offering on Thursday, braving a quiet week in Asia's debt capital markets.

-

Private equity firms are bringing new money, international expertise and fresh ideas to Colombo, hoping to rejuvenate Sri Lanka’s investment scene

-

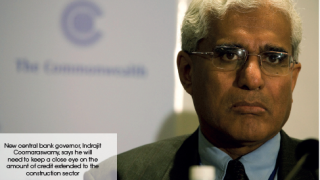

It’s boom time in Colombo’s property market, eight years after the end of the civil war, as soaring towers transform the colonial-era city into a would-be south Asian Dubai. That’s the government’s plan, but who is going to pay for it, in an economy already deep in debt?

-

Sri Lanka has sent out a request for proposals for its 2017 fundraising in the international bond market, giving firms until 3pm local time on Thursday to respond.

-

Sri Lanka has picked a consortium of six banks for a $1bn borrowing, just months after wrapping up its last loan. A pick up in sentiment around the country and its reliable track record means the latest deal will do well in syndication, with heightened interest from India providing additional momentum. Shruti Chaturvedi reports.

-

Sri Lanka has chosen a consortium of six lenders to arrange an up to $1bn borrowing, after having invited pitches from banks in January.