Most recent/Bond comments/Ad

Most recent/Bond comments/Ad

Most recent

International interest for German paper has grown

◆ Dutch lender's latest €2.5bn senior holdco follows Aussie domestic senior foray ◆ Comes a day after $1.5bn AT1 and before green RMBS ◆ Demand for senior unsecured assets is strong as ING clears big funding with limited, if any, new issue concession

◆ Issuer's first green benchmark in 2026 ◆ Blended premium estimated ◆ Central bank/official institution allocations 'notable and high' for green label

Bankers insist sustainability-linked loans are here to stay

More articles/Ad

More articles/Ad

More articles

-

Primary market unruffled, but EFSF and EU to test sentiment next week

-

Foreign investors show confidence in French assets, including innovative defence financing deal, as political concerns grow

-

German SSA issuers may adopt different strategies for upcoming deals

-

Saudi Arabian banks are stocking up on capital to fund the country's huge investment plan

-

Issuers crowd into private market, with many opting to fund in Honkies

-

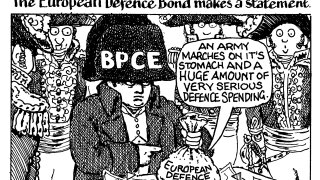

If you want peace, financially prepare for war