Spain

-

Investors rush to make the most of the pre-Thanksgiving window

-

Deal including bilateral loan will extend debt maturities

-

CK Hutchison acquired Cellnex stake by selling European towers assets to the Spanish roll-up

-

Enrique García Pazos is latest to fall victim to the bank's widespread redundancy programme

-

The Italian lender managed to score size with a slim 10bp-15bp new issue premium

-

Spain's Export Credit Agency Cesce will provide credit insurance for Iberdrola's €500m syndicated green facility

-

Strong market backdrop manifests in 10bp lower concessions for senior sales

-

Regional borrower secures €500m

-

Strong demand for euros in primary SSA market extends

-

The two-part deal was a ‘no-brainer’ due to its generous pick-up and high yield

-

Solar park operator won over investors on its second attempt to list

-

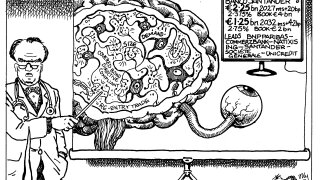

Worries that a new sovereign debt crisis is looming, despite central bank raising rates by 50bp and detailing new policy tool to manage govvie spreads