Sovereign Credit Commentary

-

Cautious optimism had been building throughout the week in the sovereign credit markets ahead of the European Central Bank meeting on Thursday and the EU summit on Friday.

-

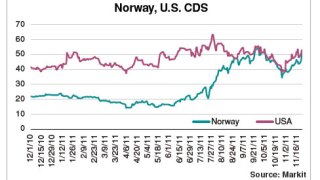

The sovereign credit market has been racked by volatility in 2011 and this week was no different.

-

The eurozone is no closer to solving its debt crisis and sovereign spreads keep widening. Unfortunately such a summary is becoming all too familiar given the apparent lack of urgency among European policymakers.

-

The announcement following the E.U. summit last week raised the stock for European policymakers. They had proved that they could work together, despite their differences, to form a cohesive and comprehensive plan to address the risks to the European financial system stemming from the debt-laden peripherals.

-

The sovereign market, indeed all financial markets, were in limbo while Europe’s leaders procrastinated over their solution to the debt crisis.

-

It’s hard to remember a week in the credit markets so driven by rumors and headlines rather than concrete news. But it was always likely to be so when there was such an important event at the end of it.

-

Perhaps the last two weeks in the credit markets can be characterized as a triumph of hope over expectation.

-

The concerns in prior months about bank liquidity for European banks, particularly access to dollar funding, gave way to concerns last week about bank capital once again.

-

The Commodity Futures Trading Commission and Securities and Exchange Commission should do their best to align U.S. swaps regulations with those of overseas jurisdictions to avoid market disruption, according to MarkitSERV CEO Jeff Gooch.

-

It became clearer than ever this week that the sovereign credit markets are beholden to the actions, or inactions, of European policymakers.

-

The financial markets were in meltdown on Thursday after the Federal Reserve’s “Operation Twist” failed to convince investors that it can rescue the world from an impending slump.

-