Sovereign Credit Commentary

-

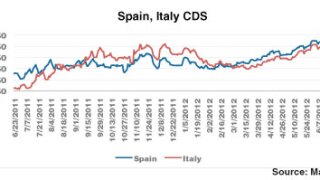

After the euphoric reaction to the European Central Bank’s new Outright Monetary Transactions—or OMT--bond-buying program, the sovereign market returned its attentions to potential obstacles blocking the path of crisis resolution.

-

Sovereign debt markets are pinning their hopes on action from the European Central Bank. Mario Draghi stoked the fires with his press conference earlier this month, when he suggested that the central bank is ready to intervene in the government bond market.

-

Sovereign spreads continued to grind tighter amid typically low summer volumes. All of the catalysts that could shift spread direction decisively--the next European Central Bank meeting, Germany’s constitutional court ruling on the ESM, a potential downgrade of Spain to junk--are in September.

-

After the initial dismay, sovereign credit spreads staged a remarkable recovery following a reappraisal of European Central Bank President Mario Draghi’s latest press conference.

-

“Whatever it takes.” Just three words uttered by European Central Bank President Mario Draghi in London this morning were enough to spark the strongest rally in sovereign credit since the EU summit late June.

-

Sovereign spreads managed to hang on to most of their gains after the June 28-29 summit, though the rally lacked conviction.

-

The rally in sovereign spreads after the EU summit on June 28-29 looked to set to have longevity by recent standards. The upticks after the Greek elections and the Spanish bank bailout agreement were over in a flash, but the Markit iTraxx SovX Western Europe index was nearly 30bps tighter at 268bps three business days after the summit.

-

Just the other day, German Chancellor Angela Merkel stated her belief that the E.U. Leaders’ Summit currently underway could be “contentious.” With the Chancellor running for re-election and bailout fatigue running high in the German populace, Germany has little desire for any type of risk mutualization without first seeing a much tighter fiscal union—something that is at least a few years away.

-

The credit default swap IMM roll on June 20, as well as the anticipation around the U.S. Federal Reserve decision made the same day, meant that it was hard to draw too much from CDS market movements this week. But that’s not to say it was without incident.

-

It’s one thing when the eurozone rescues 6% of its GDP, but quite another when it starts propping up a further 12%. As Nicholas Spiro writes, when Spain starts to flirt with insolvency, all sorts of nasty things can happen.

-

Credit markets have become accustomed to seeing spreads rally after a bailout for a peripheral country is announced. They are also familiar with the ephemeral nature of such rallies; Greece, Ireland and Portugal all saw their spreads continue to widen after the initial euphoria faded. But the rally after the Spanish bank bailout announced on Saturday has proved to be even shorter.

-

Back on March 9, 2012, the International Swaps and Derivatives Association’s Determinations Committee for the EMEA region determined that the Hellenic Republic had undergone a credit event. Leading up to that determination there had been a lot of speculation as to whether credit default swap contracts would trigger or not, and if so, under what conditions.