South Korea

-

Originator hired to go after bank bond issues in euros and dollars

-

◆ 'Successful' debut in euros for South Korean automaker ◆ Peak book tops seven times the deal size ◆ Deal lands through fair value

-

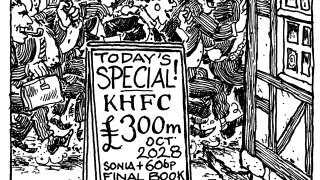

◆ South Korean lender enters sterling for the first time ◆ Spread move the biggest in 18 months ◆ Deal lands flat to fair value and euros

-

◆ Post-Seville conference pipeline builds ◆ Traffic jam possible but ample liquidity is there ◆ Kookmin takes €600m at four years

-

◆ Deal prices through fair value ◆ Strong bid for non-European names on display ◆ Trade spotted tighter post-pricing

-

◆ Deal to build on strong bid for non-European paper ◆ Investor call scheduled for next week ◆ 50bp area start possible, say bankers away from deal

-

Investors keen on duration as Thermo Fisher and Pfandbriefzentrale also go longer

-

Investors are becoming more price sensitive, said one banker

-

◆ Deal finds demand despite arrest of South Korea's president ◆ High single digit concession left for investors ◆ Leads added spread to calm concerns

-

◆ KEB Hana readies first non-European euro covered since October ◆ BSH to tap Pfandbrief demand ◆ Crédit Agricole plots public sector deal

-

South Korean policy lender kickstarts 2025 funding following a month of political chaos

-

Singaporean and South Korean lenders expected to be regular euro issuers