South America

-

Latin American investment-grade corporate paper finding exceptional demand

-

Hefty tightening fails to dampen demand as dual-tranche green deal trades up in grey

-

Bank treasuries drawn to more liquid deals as LatAm supra plans to stay active with sterling trade

-

Investors saw plenty of juice in first public AT1 from Chile as regulatory framework draws praise

-

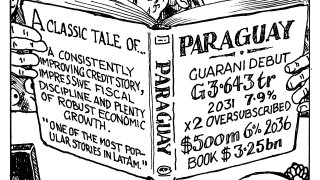

Years of credit improvements have given landlocked country a loyal following among EM investors

-

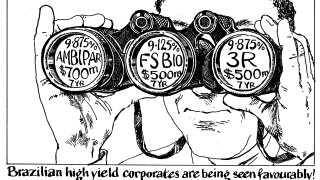

Make way for the Latin American high yield companies that put the 'emerging' into EM bonds

-

Latin American corporate issuance comeback has beaten the expectations of some investors

-

Oil and gas junior becomes LatAm's first debut issuer of the year with Ambipar to come

-

Appetite for 30-year strong as LatAm’s largest sovereign notches its biggest new money trade

-

Multilateral lender says greater liquidity in its deals has helped it to lure new investors

-

Top sovereign opts for defensive maturity and bucks trend of LatAm issuer generosity

-

Brazilians set to join the party as Latin American deals trade up despite EM outflows