Société Générale

-

Belgium dropped into the long end of the euro curve to place a 100 year bond this week – its first private placement for seven months.

-

Ceconomy, a German consumer electronics company, has signed a €1.06bn revolver linked to sustainability metrics, becoming the latest corporate to repay state support loans taken out during the worst of the coronavirus pandemic.

-

Emirates telecom provider Etisalat landed in the euro market with a bond on Thursday, raising €1bn across two tranches in a currency that is fast becoming a home for EM borrowers.

-

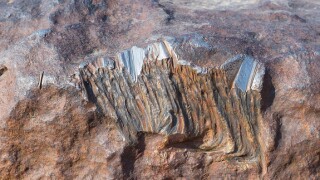

The demand for sustainability-linked bonds was made clear on Thursday, as French minerals company Imerys’s deal commanded more than double the demand of Swedish property firm Sagax’s conventional trade, despite sharing big similarities.

-

Bank of Ireland and Westpac found strong demand for debut green tier two deals this week, as investors flock to this growing segment of the ESG market in search of higher returns.

-

Europe’s high grade corporate bond investors clamoured for spread this week, with low triple-B rated companies Aker BP and Holding d’Infrastructures de Transport (HIT) finding ample demand a day after Eni had sold hybrid debt.

-

Euronext, the Dutch-registered, Paris-headquartered stock exchanges group, brought a €1.8bn triple tranche bond issue on Thursday. Investors showed much larger appetite for the shortest maturity as inflation fears linger.

-

Société Générale posted impressive earnings on Thursday. Like other banks, it had hyperactivity in equities to thank in part for the robust quarter, though the French firm also pointed to a boom in energy, infrastructure and other asset-based financing activities.

-

Westpac jumped into the green tier two market for the first time on Thursday, finding plenty of demand for the subordinated and labelled combination.

-

Europe’s high grade corporate bond investors showed for the second day in a row on Wednesday how hungry they are for spread. Low triple-B rated credits Aker BP and Holding d’Infrastructures de Transport both increased their bond issues after bumper demand.

-

Greece sold the first and only public sector benchmark deal of the week on Wednesday. However, issuers are preparing to return in force in euros and dollars next week, according to bankers.

-

Westpac is set to sell its first green tier two deal later this week, becoming the latest financial name to tap growing demand for labelled subordinated debt.