Shanghai Pudong Development Bank

-

Yorkie Wong had worked at HSBC and Shanghai Pudong Development Bank

-

Jewellery-to-property firm makes loan return, soon after divesting some of its assets

-

-

The facility will be used to refinance a loan maturing in May

-

Issuers turn to bonds to support property acquisitions, but any ease up in liquidity pressure is set to be limited

-

Two Chinese developers join the bank to issue bonds supporting property acquisitions

-

Avic International Leasing Co turned to the euro market on Tuesday for a sub-one year bond, but the deal’s short tenor and a rough issuance backdrop led to tepid investor response.

-

Shanghai Pudong Development Bank (SPDB) leaned on a large syndicate team to sell a dual-currency bond that was mainly bought by other Chinese banks.

-

Genertec Universal Medical Group, a Hong Kong-listed healthcare services company, has received strong response during syndication for its latest loan.

-

The recent round of M&A and leveraged buyout financing provided by Chinese banks shows their growing ambition in the more complicated and riskier part of Asia’s loan market.

-

Chinese online human resources service provider 51job has raised a $1.825bn term loan from two banks to support its take-private.

-

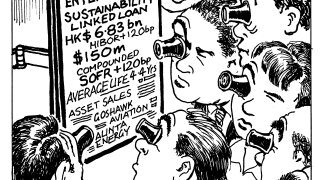

Chinese state-owned company Genertec Universal Medical Group has returned to the loan market to syndicate a $700m-equivalent deal.