The big question around the revival of Europe's commercial mortgage-backed securities market has been when issuers start bringing out deals that go beyond the safest property types, like warehouses and light industrial facilities.

Bank of America answered this question with its £376m Taurus 2025-2 UK deal on Wednesday.

It is backed by two big ticket loans, one, worth 30% of the deal, on the Silverburn shopping centre in Glasgow, and another to Lone Star which includes 28% London office property and retail parks.

The only issue — the execution was far from flawless. After a capital structure revision on Tuesday, the triple-A and double-A notes were priced at the wide end of initial price thoughts on Wednesday, while the single-A and triple-B tranches had to be widened from IPTs by 20bp and 60bp, to land at 250bp and 320bp over Sonia.

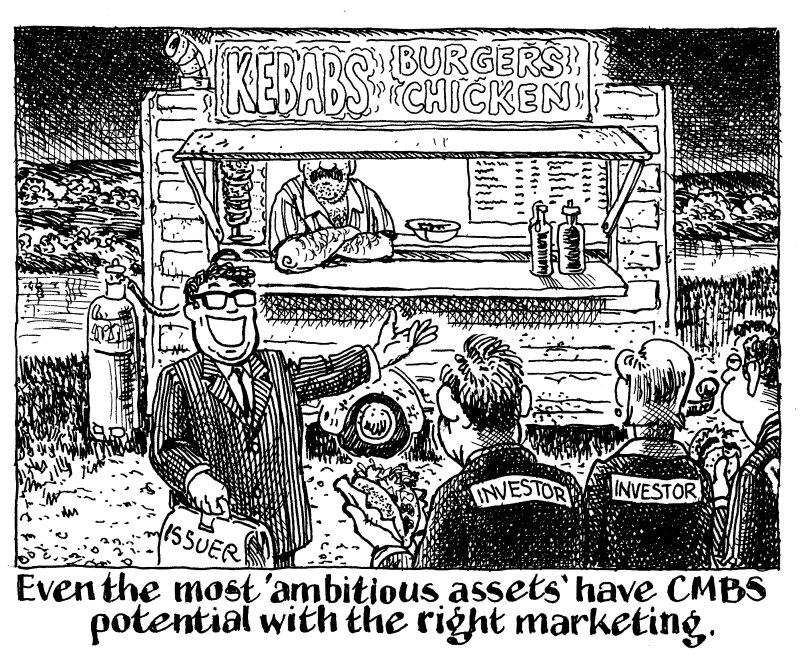

Other CMBS issuers with similar collateral in their portfolios may be looking at this result and concluding that now is not the right time to come to market with more ambitious assets.

That would be the wrong lesson to draw.

CMBS issuance in Europe last year was only €2.8bn, compared with €120bn for residential MBS, according to the Association for Financial Markets in Europe.

It is almost inevitable that in such a small market a CMBS deal containing property types investors are warier of would have some teething troubles. It is inevitably difficult to know in advance how tranches will need to be priced, especially junior notes.

Taurus should serve as a teachable moment.

These deals should not be rushed. Bank of America initially expected to price it in just over a week. That was unrealistically tight — future deals should have longer marketing periods.

The other lesson is that you must work incredibly closely with investors. Future issuers must make sure investors’ concerns are addressed, possibly through premarketing.

Bank of America should absolutely be commended for taking the first step in reviving the asset class. Now it’s up to other issuers to learn from these early difficulties and adapt.