Paragon Bank’s buy-to-let RMBS has certainly divided the GlobalCapital newsroom.

On one side of the debate, George Smith argued in a column that the deal lays bare the failures of the regulatory framework for RMBS. On the other side, covered bond editor Frank Jackman writes to encourage more issuers to put securitizable collateral into their covered bonds.

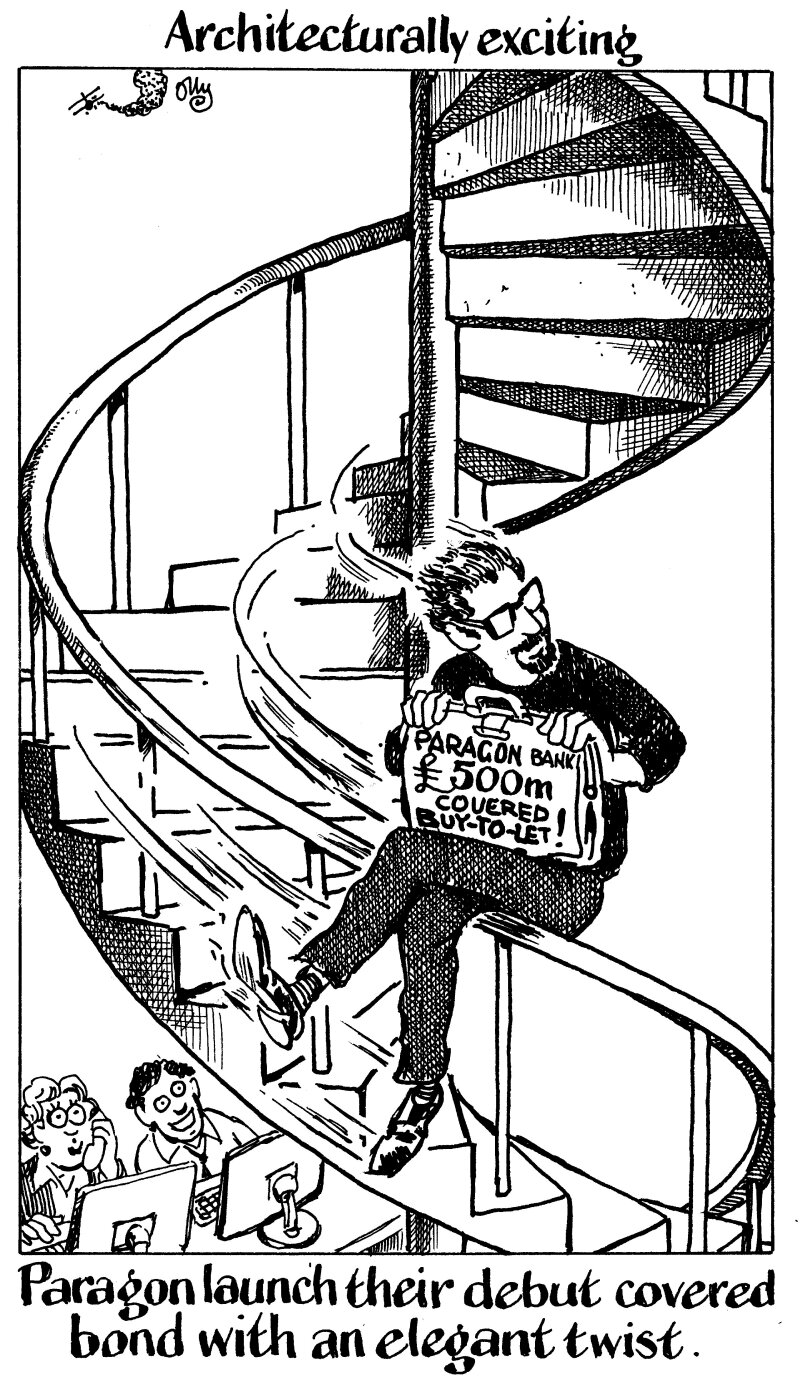

Our pair of asset-backed hacks chewed over what it all means with Tom Hall on Another Fine Mezz this week. One thing that is for sure is that the deal merited its cartoon!

Last week's primary activity did bring some good news for RMBS, as Virgin Money printed its latest Lanark inside where its most recent covered bond is trading. It was a slim premium, though — not the 5bp to 15bp needed to make RMBS cheaper for banks to issue under the current regulatory framework.

For banks on the buy side, relative value might look unattractive compared with covereds or Gilts. For securitization asset managers, however, it arguably looks relatively attractive compared with buy-to-let in the low 70bp area. Then again, such calculations might soon be a problem for covered bond investors.

Those considerations are reflected by the distribution stats. 27 investors were allocated, with asset managers taking down 70% and banks subscribed for the rest.

GlobalCapital reported on similar trend for Santander’s Holmes in January. Also notable was the amount of overseas interest at 18%, the same as Holmes. It was common for a while to see UK investors account for nearly the entire book.

Investors might need more to buy if issuers start taking Frank’s advice!