At a superficial glance, Europe’s securitization market might seem pretty healthy. It broke a post-2008 financial crisis issuance record in 2024, and three debut deals have already come this year from Nottingham Building Society, Leasecom and OLB.

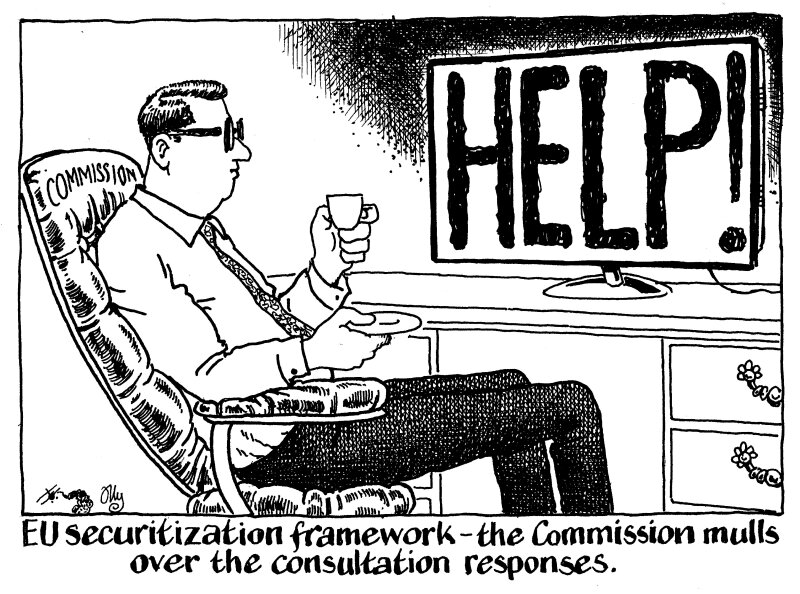

Meanwhile, the European Commission is mulling over 131 responses to its consultation on the functioning of the EU securitization framework, many of which claim the market is on its knees and regulation needs urgent reform.

The Commission might be tempted to look at the recent activity and conclude that it undermines those claims. To do so would be a mistake.

This is a moment when the securitization market was always likely to grow for two key reasons.

First, cheap liquidity from central banks is draining from the system and interest rates are finally above the rate of inflation. That pushes banks like OLB and building societies like Nottingham to diversify their funding and RMBS is an obvious place to look.

Second, Basel regulations are slowly coming into force around the world. That tightens capital constraints on banks, forcing them either to scale back on lending, opening the door to specialists like Leasecom, or to seek credit protection, often by issuing securitizations themselves.

In fact, considering how powerful those factors ought to be, the growth of securitization should be considered a little disappointing. At the end of the third quarter of 2024 — the most recent data published by the Association for Financial Markets in Europe, a trade body — the outstanding volume of European securitization stood at €1.19tr, up from €1.18tr at the same point in 2023.

Minimal actual growth, which reflects how much of the activity last year was just the refinancing of deals, at a point in time which should be perfect for the growth of the securitization market.

Maybe the Commission’s work is worthwhile after all