The UK government is pretty clear about its aspiration to boost growth. It even asked the country's financial regulators to come up with ideas on how to achieve its ambition, and has reportedly sacked the head of the Competition and Markets Authority after it offered underwhelming proposals.

In its response, the Financial Conduct Authority proposed fiddling with mortgage rules and “opening a discussion on the balance between access to lending and levels of defaults”. Given the shortage of housing in the UK, it’s hard to believe that would be anything other than inflationary.

Growth through asset price inflation builds systemic risk and does little for the "working people" that the government claims it wants to make better off.

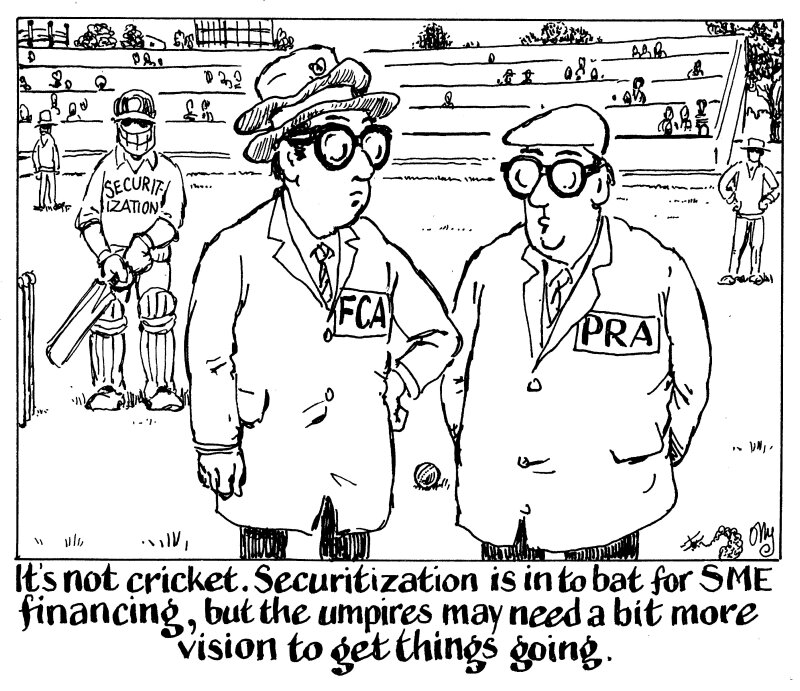

A better idea would be to boost SME financing, which would be immediately productive.

Securitization is ready to play its part, as recent progress shows. For a long time, only Funding Circle had made any serious headway in the cash market in Europe, but in the last few years other have joined in.

There are now Capital on Tap with SME credit cards and Barings with a middle market CLO, as well as other lenders like ThinCats and Teylor said to be looking at doing deals.

Equipment leasing is also on the rise as an asset class with names like Hiltermann and Haydock leading the way. When it comes to bank issuance, SMEs are a reasonable share of the thriving SRT market.

But this is all happening in spite of a difficult regulatory landscape.

The size of SME loans makes them difficult to securitize. On the one hand, they are not granular enough to treat as equivalent to consumer loans, and on the other hand they are not big enough for name-by-name underwriting.

Some careful thought about how to make that work better is needed and it starts with more appropriate investor due diligence requirements and originator disclosure templates, which are under the control of the FCA and Prudential Regulation Authority.

Both should seize the opportunity to power up securitization and, to use the phrase of the previous government, level up the country.