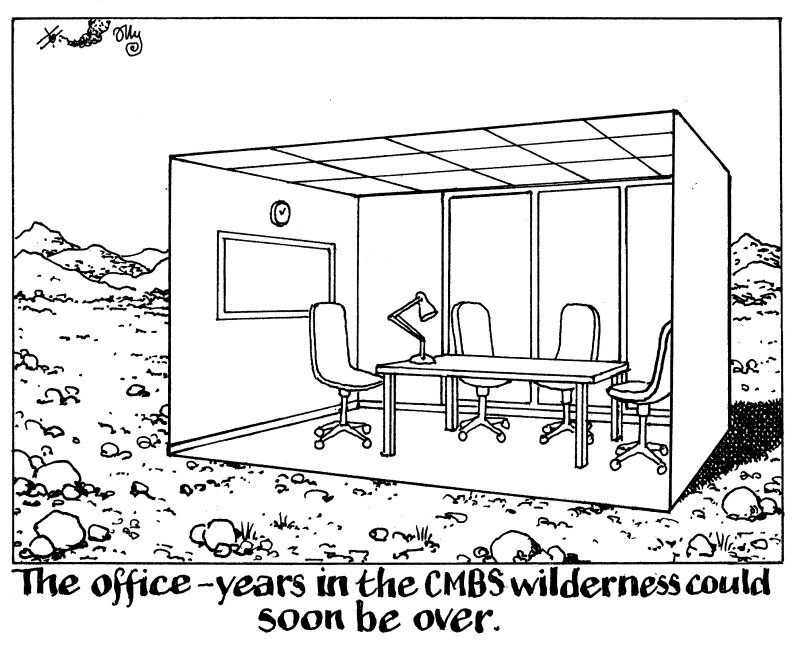

Followers of the CMBS market this year, would be forgiven for thinking the only assets that can go into a deal are logistics warehouses and data centres. Office and retail assets are still caught up in a swirl of negativity, around higher interest rates and shifting trends in whether or not people use them.

With downgrades piling up, new issuance in those sectors was always going to be tough. Yet, it turns out that, for the right kind of office, a deal can be done.

Bank of America and BNP Paribas pulled off the first deal of the second half of the year this week, with Hera Financing 2024-1, backed by a loan secured on leases originated by Blackstone and Brockton JV Fora.

Admittedly, placing the deal with an arranger’s trading desk means primary market investors haven’t given it their stamp of approval.

But BofA is confident enough to take down the whole £220m CMBS, which is a clear vote of confidence in the assets. As is BNPP, Morgan Stanley and Blackstone providing the rest of the financing in a £300m loan.

The spreads aren’t outrageous either — 190bp on the seniors might be a little wide of Blackstone’s logistics trade at 165bp done in May, but it’s well inside the 235bp the same sponsor paid in July last year.

The success is not surprising as the assets involved are a natural fit for securitization financing. Only one loan backs the deal adding some risk, but it is secured on a much more granular portfolio than many CMBS trades. There are 489 leases involved across 19 assets.

Office assets’ years in the wilderness are coming to an end as valuations recalibrate and rates begin to fall. Demand for offices might never be the same as it was before Covid, but there is still a market for flexible workspaces and securitization can still finance it.