In most markets, deals hitting screens at such a rapid pace in August as they are this week in European securitization would be a cause for celebration. And adrenaline is running high.

Some are expecting 25 deals at least in the next couple of weeks. “Carnage”, was how one banker described it.

“It’s going to be a mess,” said another.

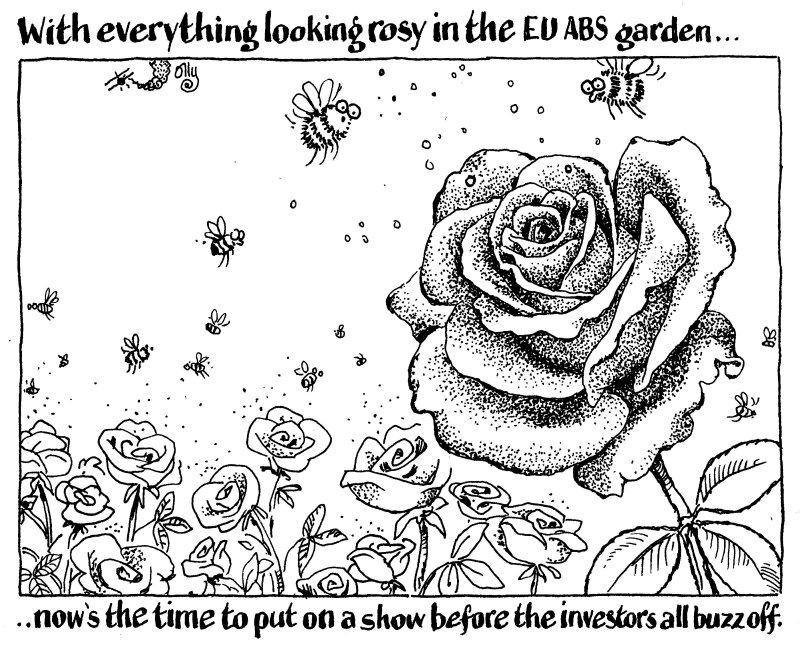

In the relatively small community of European ABS, though, it immediately has people worrying: how long can the party last?

For now, they are not complaining. As another banker said, to do so would be a bit like lamenting the hot weather in London after experiencing nine months of rain.

Moreover, demand is clearly out there, as Bank11’s prime German auto ABS, RevoCar 2024-2, showed with tightening on the triple-As from 60bp over one month Euribor to 56bp.

Yet this is European ABS. Investors might be hungry for paper, but they fill up pretty quick.

With demand looking good, and the first couple of deals going smoothly, sensible syndicate desks are going to get good deals away with a minimum of fuss.

There is always a risk that someone, in desperation to price, pays up by 10bp just to get a deal done. This could reprice the entire market.

But with so much competing supply already out there, issuers should not be put off if that happens. It is important to consider the bigger picture, and get deals done when the window is open. Quibbling over a handful of basis points is unnecessary — and could be counterproductive.

Get in, get out. While you still can.