Imagine a segment of capital markets, rather indecipherable to laymen, comprised of complex feats of financial engineering, backed largely by pretty small loans to consumers and homeowners, and that once was at the centre of an unprecedented global financial crisis.

Surely, such an asset class would have come tumbling down when recession fears spiked earlier in August?

In fact, this market, US securitization, barely paused as stocks had a meltdown on August 5. Issuance carried on regardless, and some jumbo deals this week — including an auto ABS from Santander — were even priced at spreads in line with where they would have priced before the volatility.

For, despite having a reputation as somewhat racy and exotic — and though several senior bankers continue to suffer PTSD a decade and a half after the financial crisis, believing their market is terribly misunderstood — securitization today is, for the most part, actually pretty boring.

Sure, occasional funky deals do emerge, with the Sotheby’s art-backed ABS the most eye-catching example this year. But US ABS generally comprises repeat issuers bringing nearly identical structures each time, with similar collateral and predictable timing.

What’s more, the beauty in securitization lies in how boring most of it is.

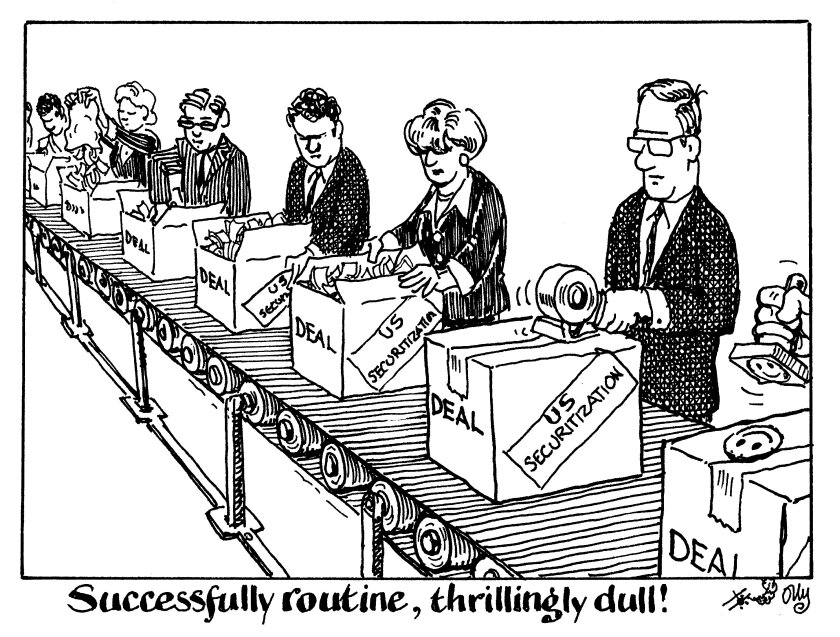

Securitization is a market that rewards issuing for being a programmatic, not exotic. It has become a production line of deals where issuers and investors have built mutually beneficial relationships, offering investors predictability yet diversity as well as the risk profile that they desire, and giving issuers an extremely reliable funding option.

It is proven as a model to efficiently motor the provision of credit to the US economy. It does not need to be fancy or complicated. It just needs to work, and continue to attract more investors.

Yes, weird and wacky deals are undoubtedly fun, both for the bankers structuring them and the journalists reporting on them. This is not to discourage them. But they are feasible only because the predictable securitizations of on-the-run assets continue to provide a proof of concept and keep the market rolling day-by-day.

Securitization is boring. Let's keep it that way.