The CLO market, across Europe and the US, is having a belter of a year. But once a bad name sticks, it's hard to brush it off.

More and more investors are adding collateralised loan obligations to their portfolios, and so they should. Where else can you get well over 100bp of spread on short dated triple-A paper?

One long-serving US CLO manager said this week that these are the best conditions he’s seen in a career of more than 30 years.

Demand is increasingly coming from Middle Eastern and Chinese banks, as well as US asset managers, he said.

Meanwhile, Japanese bank Norinchukin is adding to its CLO portfolio (among other things) after bets on US and European government bonds went wrong.

Triple-A CLO notes have tightened around 50bp since the start of the year, enabling mass repricings and creating a flood of issuance. Already, total volume is at $184bn — nearly $60bn more than in the whole of 2023.

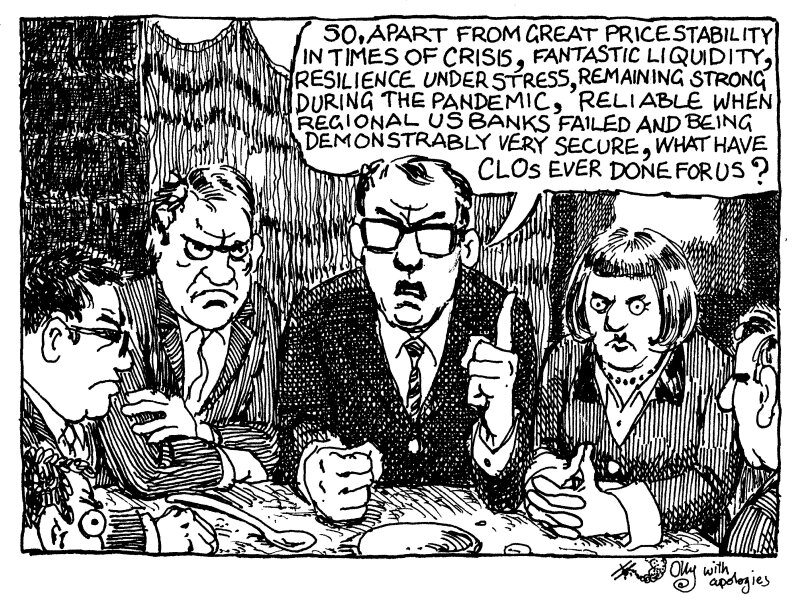

Yet for all that, CLOs are still a special interest market. Those outside the club of initiates pay no heed to the market’s successes. To them, none of it matters because 2008 proved they were “risky” investments.

What sort of performance does an asset class need to be classified as “risky”? What sort of returns must it offer? How unstable should it be in times of crisis?

No one knows, or cares, but they know without a shadow of a doubt that CLOs are risky.

Yet since the dark days of the global financial crisis, CLOs have proved themselves a strong asset class time and again, as the graph below from Bank of America Research shows.

CLOs have been stable through a sovereign debt crisis, a pandemic, a war in Europe, and regional US banks failing. Yet they are still deemed unreliable.

Perhaps it’s time to give CLOs a fresh look.