For the past year, the broadly syndicated loan market has been a desert with a few refinancings and lots of tumbleweed. This has been painful for lenders and their captive audience, the CLO managers who need assets to fill their portfolios.

But the new year comes with new hope. Sources across the market acknowledge the potential for borrowers which turned to private credit in the tough market of 2022 to refinance their deals in the BSL market.

The non-call periods on some of these unitranche loans from direct lenders end this year. Meanwhile, banks have renewed appetite for credit underwriting and CLO managers are expected to issue €25bn-€30bn of deals in 2024.

In the BSL market, a company can borrow money at 425bp over three month Euribor, a loan banker said this week, while private credit lenders cannot reasonably go below 525bp, which is already a stretch.

But being reasonable might not be the top priority for direct lenders this year. The sector has boomed in the past few years. Every week, another asset manager raises huge sums for its private credit fund. This week, it was Arcmont with €10bn.

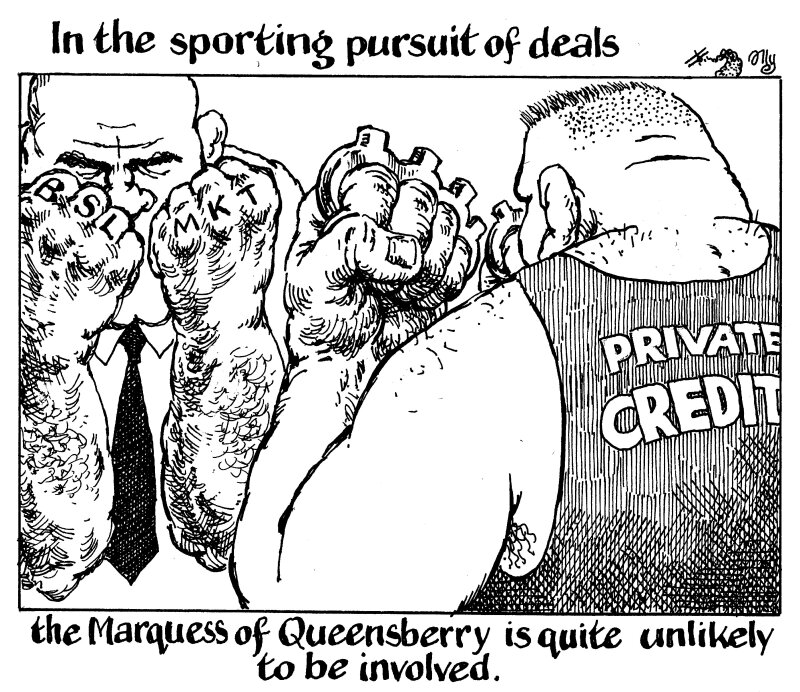

For them, deploying cash is the priority. Sharp pricing comes second. Yes, KKR’s head of debt advisory told GlobalCapital that his clients are exploring refinancing private credit deals in the BSL market. But we have also heard of direct lenders dropping their prices and scrapping covenants to win business from the syndicated market.

Leveraged buyouts will not come back this side of summer. BSL bankers — and by extension CLO managers — will have to scrap for deals with the high yield bond and private credit markets.

It is a great time to be a high quality borrower but it’s much less fun for almost everyone else.