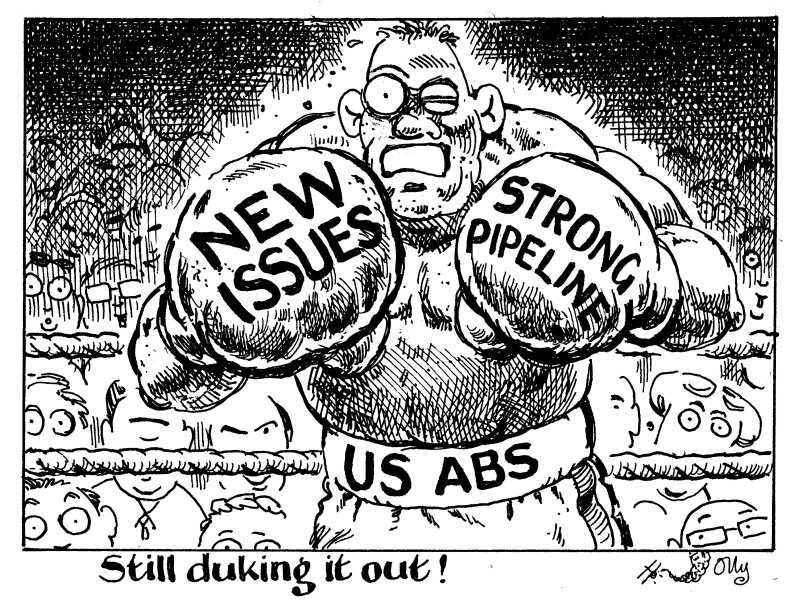

The US asset backed securities market is back, and it’s only going to get better. Ripe conditions mean that investors must accept that post-pandemic era heightened credit risk isn’t going anywhere and focus on the relative value that exists within the asset class.

Doomsday predictions of yesteryear about US ABS are washing away — even though there has been little improvement in delinquency and loss data ABS structures — as easing inflation and strong employment data calm investors.

And, as a result, demand continues to increase, driving spreads tighter for new issue ABS.

The outlook was less rosy in the second half of 2022, with ABS market participants much more pessimistic overall. Inflation and the risk of a looming recession struck fear into American consumers and put pressure on their debt management. Historically wide spreads and lower than expected demand in the last quarter of 2022 reflected this.

However, because lending standards have tightened in recent months better performance should follow, suggest sources, making the ABS primary market an even more attractive prospect.

Investor sentiment has taken notice of its resiliency in a turbulent year. Turmoil in the banking sector, weakening consumer credit fundamentals and several downgrades failed to strain the ABS market. Although uncertainty about interest rates remains, with spreads still at historically wide levels it is time for investors to quit trying to predict the future and focus on the opportunities staring them in the face: new issue ABS.

Many already are, subscribing to the hope that US ABS will perform better than expected in the year to come.

For example, the Bank of America ABS research team updated its annual volume projection from $225bn to $250bn last week, also expressing more positivity on credit fundamentals. JP Morgan and Bank of America both expect spreads to tighten by the end of the year.

High rates for longer than expected proved difficult for the new issue market. But issuers persisted consistently in the first half of the year, bringing more than $140m of new volume, according to Finsight data. New issuers such as TierPoint and Jonah Energy also entered the market this year, alongside some older names such as Porsche, which made a comeback after several years of absence.

It may be happening at a slow pace, but investor appetite is recovering from a rocky couple of years. As spreads continue to tighten — and it is, of course, unclear where the interest rates will end the year — the best time to take advantage of the ABS market is now.