The centrepiece of the banquet that is European securitization regulation is the simple, transparent and standardised (STS) hallmark.

Deals qualify if they meet each of those criteria, the implication being that they are free of any of the chicanery that many accused the securitization market of in causing the 2008 financial crisis.

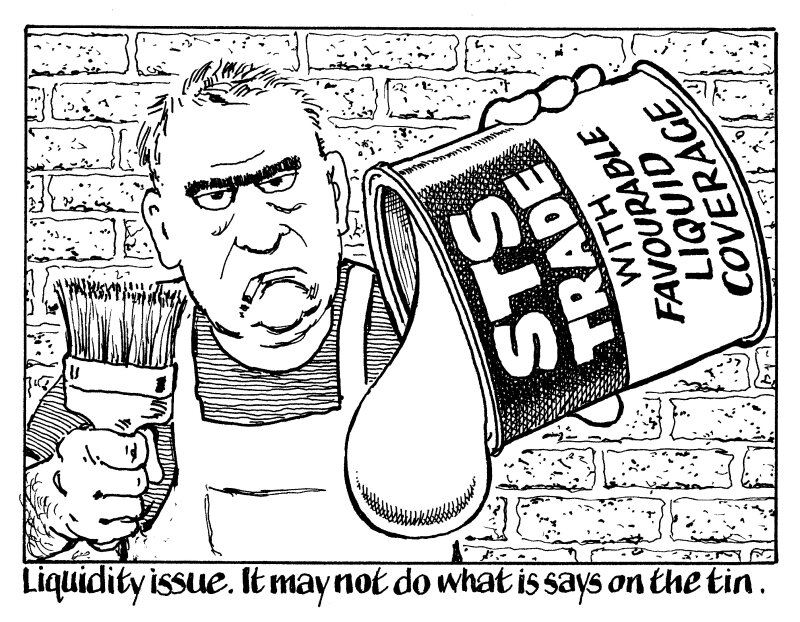

An STS qualification conveys favourable regulatory treatment under the liquidity coverage ratio (LCR) because regulators are confident that the paper will be of high quality throughout its life.

But quality is not the same as liquidity. The LCR is an important piece of regulation itself, designed to ensure banks can survive liquidity stresses, so surely LCR eligibility should be based on the liquidity of the securities in question.

In general, securitizations are more liquid than the regulations give them credit for, and there’s a strong case that more deals should qualify as LCR eligible.

But the point is that some STS trades can be as liquid or illiquid as some of their non-STS counterparts.

A recent blog from TwentyFour Asset Management pointed to Charter Court’s CMF programme, labelled STS. It said CMF trades “with similar levels of liquidity to non-prime deals”. Charter Court has chosen not to call deals at the step-up date on two previous occasions.

Call dates are sometimes missed when refinancing is uneconomical, but rarely by traditional prime lenders. The possibility of a call option not being exercised makes a deal less attractive as investors risk not getting their principal back for longer.

Refinancing is likely to be expensive during a period of liquidity stress, so the demand for a deal, STS or not, could drop just at the moment banks need to sell.

There are other issuers that always endeavour to call their deals but don’t qualify for STS simply because they don’t originate enough collateral to do a purely owner-occupied loan backed deal.

Those specialist issuers are going to be competing for investors’ attention against returning prime lenders as the big banks lose central bank funding. They will need help from regulators to boost their access to the market.

It is the perfect moment to untangle the STS-liquidity granny knot.