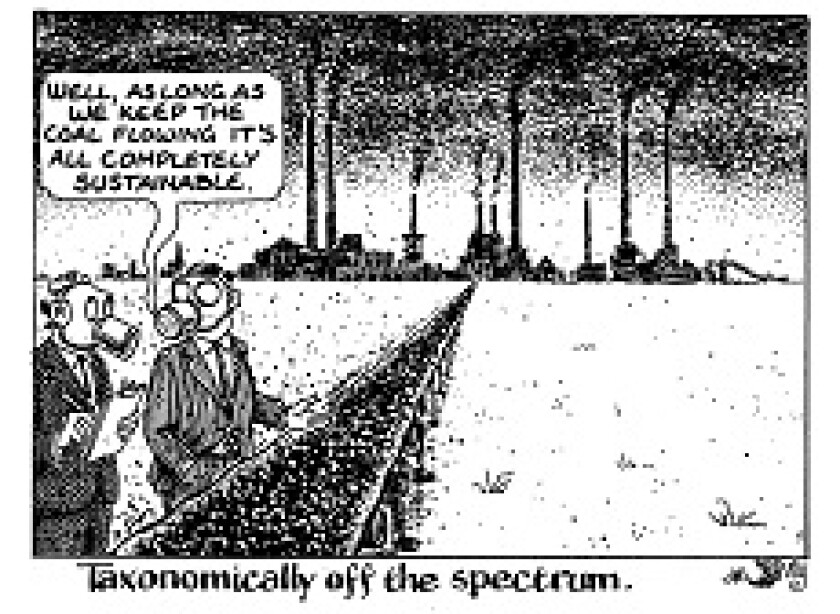

Inspired by green bond thinking, it is a grand classification of sustainable economic activities, to guide investors who can’t decide for themselves what green means, and prevent ‘greenwashing’ — marketing things as green that aren’t.

Supporters claim defining ‘sustainable’ will enable the market to move capital to better investments and shift the economy to a safer path.

Now the European Parliament has called their bluff. At least, it had until centre right members got cold feet. MEPs have proposed including in the Taxonomy a list of all the things that are bad for the environment.

These would have to be identified anyway under the Taxonomy, since activities that cause significant harm to the environment are excluded, even if they are good in another way.

But gathering all the sins together into one list would certainly make it easier to spot the corporate villains. There might be red faces at many firms that usually wear halos.

You might expect oil companies to hate this, but the condemnation is wider. Efama, the European asset managers’ trade body, opposes it.

In doing so, they undermine the whole logic of the Taxonomy, which was that giving investors official, harmonised standards of sustainability would speed up the transition.

If markets do have a role to play, and official Taxonomies are at all useful, they have to point out the practices that must end, as well as sunrise industries. Ideally, the Taxonomy would indicate several shades of green and brown.

Not mentioning the bad, to spare companies’ blushes, is as bad as greenwashing.