Scotiabank

-

Second Canadian lender to declare official support for embryonic SSA issuer as government takes lead on establishing new entity

-

FIG issuance comes across the capital structure before US banks' earnings

-

US FIG issuance spikes above $90bn ahead of expected Fed rate cut

-

Market participants hope more jurisdictions will follow as Canadian duo attract record demand

-

◆ Scotia moves quickly to tap resurgent sterling market ◆ Trade lands through CIBC and flat to fair value ◆ Confidence returns to sterling covered investor base

-

◆ NIB, IADB, CEB price bonds ◆ Busy week drains liquidity from market ◆ Treasury spreads at 'historic' tights

-

◆ Four issuers out in dollars, three in the same maturity ◆ Swap spread moves foil tightening potential ◆ Deals getting done, but market isn't 'white hot'

-

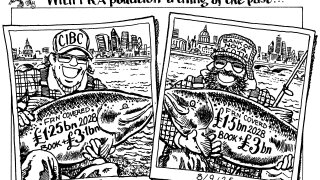

◆ Canadian bank competes in busy session ◆ US dollar equivalence debated ◆ Fast money favours higher yield

-

◆ First five year dollar from the issuer since 2021 ◆ L-Bank print provided building block ◆ Further dollar deals planned

-

◆ EIB breaks its previous record ◆ Bond prices tight ◆ Deal could inspire further 10 year issuance

-

US money center bank's perp propels systemically important firms' January issuance to near-$49bn monthly record

-

Goldman Sachs took advantage of strong demand before passing the issuance baton to foreign banks and domestic borrowers