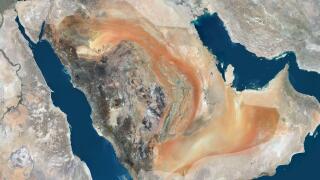

Saudi Arabia

-

Deal is only fourth accelerated sale in a quiet year for Saudi blocks

-

Market is particularly interesting for banks doing capital trades

-

Company has offered the highest yields on Saudi Arabian new issues in the last few years

-

Investors are growing full of heavy subordinated issuance

-

Comps are the owner, PIF, and bonds from aircraft lessors around the world

-

Five banks in the GCC have opened books, or plan to, on new paper this week

-

A pair of Gulf issuers are considering adding to the resurgence in euro issuance from the region

-

The wealth fund hopes to secure a funding arbitrage compared to dollars

-

Recent Gulf euro issuance has been 'very tightly priced' to dollars

-

Deal attracts strong investor appetite from exclusively Asian lenders

-

Saudi mortgage provider will offer a premium to its sovereign, and deal will carry a guarantee

-

The Saudi mortgage provider trades about 15bp-20bp over the Kingdom's curve